The cryptocurrency market is experiencing significant turbulence as Bitcoin and Ethereum prices tumble dramatically, sending shockwaves through the digital asset ecosystem. In recent trading sessions, both leading cryptocurrencies have plunged toward their lowest levels in three months, triggering widespread concern among investors and market analysts. Bitcoin, the world’s largest cryptocurrency by market capitalization, has shed substantial value alongside Ethereum, the second-largest digital asset, creating a ripple effect across the entire crypto landscape. This cryptocurrency price crash has left many investors questioning whether this represents a temporary correction or the beginning of a more prolonged bearish trend. Understanding the factors driving this crypto market downturn is crucial for both seasoned traders and newcomers navigating these volatile digital waters.

Current Cryptocurrency Market Crisis

Why Bitcoin and Ethereum Prices Tumble in Today’s Market

The current market conditions reflect a perfect storm of factors contributing to the dramatic decline. Bitcoin and Ethereum prices tumble when multiple bearish indicators converge, and that’s precisely what’s happening now. Bitcoin recently dropped below critical support levels, falling from its previous highs to test price points not seen since mid-summer. Ethereum has followed suit, experiencing similar downward pressure that has erased weeks of gains.

Market analysts point to several interconnected reasons behind this crypto price decline. First, macroeconomic headwinds continue to pressure risk assets globally, with cryptocurrencies bearing the brunt of investor risk aversion. The Federal Reserve’s monetary policy stance, inflation concerns, and geopolitical tensions all contribute to the broader market uncertainty that disproportionately impacts digital assets.

The Domino Effect Across Digital Assets

When major cryptocurrencies like Bitcoin and Ethereum experience significant price drops, the entire cryptocurrency market typically follows. This phenomenon occurs because Bitcoin and Ethereum collectively represent over 60% of the total crypto market capitalization, making them bellwether assets for the sector. As Bitcoin and Ethereum prices tumble, altcoins—smaller alternative cryptocurrencies—often experience even more severe declines due to their higher volatility and lower liquidity.

The crypto market crash has affected thousands of digital assets, with many experiencing double-digit percentage losses within hours. Trading volumes have surged as panic selling intensifies, creating a feedback loop that accelerates price declines. Derivative markets have seen massive liquidations, with leveraged positions being forcibly closed, adding further downward pressure on spot prices.

Key Factors Behind the Bitcoin and Ethereum Price Collapse

Regulatory Pressures and Government Crackdowns

One primary driver of the tumble in Bitcoin and Ethereum prices is increasing regulatory scrutiny worldwide. Government agencies across multiple jurisdictions have intensified their oversight of cryptocurrency exchanges, DeFi platforms, and digital asset service providers. Recent enforcement actions by the Securities and Exchange Commission (SEC) and similar international regulatory bodies have created uncertainty about the legal framework surrounding digital assets.

The cryptocurrency regulation landscape continues evolving rapidly, with proposed legislation threatening to impose stricter compliance requirements on exchanges and wallet providers. These regulatory developments often trigger sell-offs as investors fear potential restrictions on trading activities or mandatory reporting requirements that could impact privacy and accessibility.

Technical Analysis: Breaking Critical Support Levels

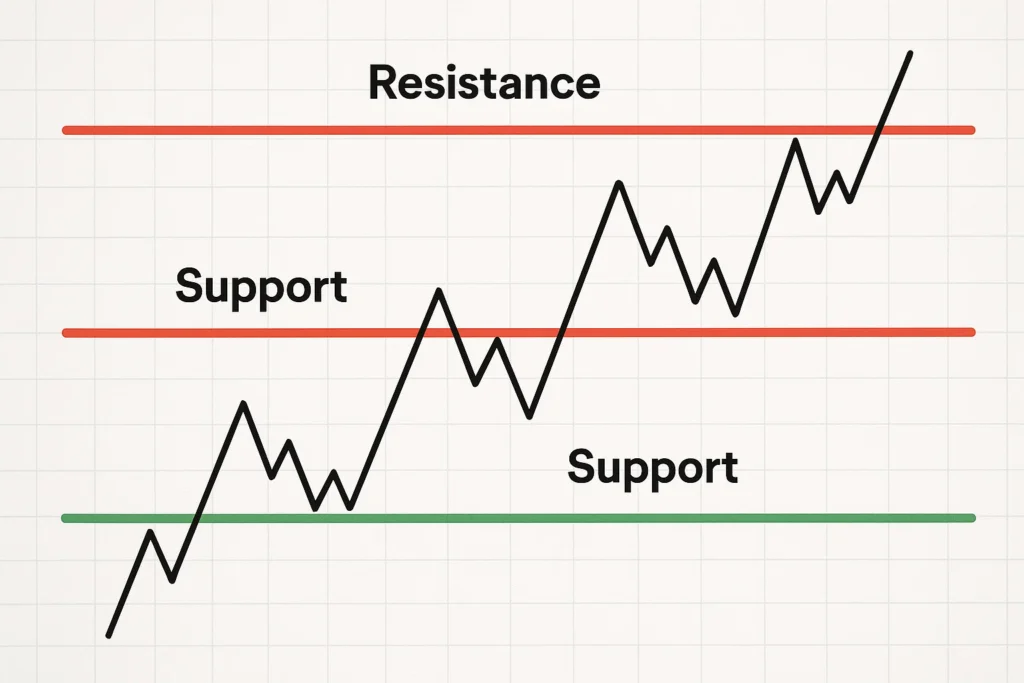

From a technical perspective, both Bitcoin and Ethereum have breached significant support zones that previously held firm during minor corrections. Bitcoin price analysis reveals that the cryptocurrency fell below its 200-day moving average—a key technical indicator that many traders use to gauge long-term trend direction. This breakdown often signals the potential for extended bearish movement.

Ethereum technical indicators paint a similarly concerning picture, with the asset failing to maintain crucial psychological price levels. The breakdown of these support zones has triggered stop-loss orders and algorithmic trading programs, creating cascading selling pressure. Chart patterns suggest that without a strong catalyst, both cryptocurrencies could continue testing lower price levels before finding a stable footing.

Macroeconomic Concerns and Traditional Market Correlation

The correlation between cryptocurrencies and traditional risk assets has strengthened considerably in recent years. When Bitcoin and Ethereum prices tumble, it often coincides with weakness in technology stocks and other growth-oriented investments. Current macroeconomic concerns—including inflation persistence, rising interest rates, and recession fears—have created an environment where investors flee to safe-haven assets like cash and government bonds.

The crypto market volatility reflects broader economic uncertainty. As central banks worldwide maintain restrictive monetary policies to combat inflation, the liquidity that previously fueled crypto market rallies has dried up substantially. Higher interest rates make yield-generating traditional investments more attractive compared to speculative digital assets, drawing capital away from the cryptocurrency sector.

Impact on Cryptocurrency Investors and Market Sentiment

Portfolio Losses and Investor Psychology

As Bitcoin and Ethereum prices tumble, millions of investors worldwide are experiencing significant portfolio losses. The psychological impact of watching substantial wealth evaporate cannot be understated. Many retail investors who entered the market during previous bull runs now find themselves holding assets at a loss, facing difficult decisions about whether to sell and realize losses or hold through the downturn.

Crypto investor sentiment has shifted dramatically from optimistic to fearful. Social media platforms and cryptocurrency forums reflect growing anxiety, with many participants questioning the long-term viability of their investments. The Fear and Greed Index—a popular sentiment indicator for crypto markets—has plunged into “extreme fear” territory, suggesting widespread pessimism among market participants.

Institutional Response to the Cryptocurrency Downturn

Institutional investors, who were once seen as the catalyst for crypto market maturation, have adopted a more cautious stance as Bitcoin and Ethereum prices tumble toward multi-month lows. Some institutions have reduced their cryptocurrency holdings, while others have paused planned allocations until market conditions stabilize.

However, not all institutional players are retreating. Some sophisticated investors view the crypto price crash as a buying opportunity, accumulating assets at discounted prices. This divergence in institutional behavior creates interesting market dynamics, with long-term believers absorbing selling pressure from short-term speculators and overleveraged traders.

Comparing This Decline to Previous Cryptocurrency Bear Markets

Historical Context: How This Crash Compares

To understand whether the current situation represents an exceptional crisis or a typical crypto cycle correction, examining historical precedents is essential. Bitcoin and Ethereum prices tumble periodically throughout their history, with several notable bear markets providing context for today’s conditions.

The 2018 bear market saw Bitcoin decline approximately 84% from its all-time high, while Ethereum dropped over 90%. The 2022 crypto winter brought similar devastation, with both assets losing roughly 75% of their peak values. Compared to these historical drawdowns, the current decline—while significant—remains within the range of normal cyclical corrections that characterize cryptocurrency markets.

Recovery Patterns and Timeline Expectations

Historical cryptocurrency market cycles suggest that bear markets typically last between 12 and 18 months before sustainable recovery begins. However, each cycle exhibits unique characteristics influenced by prevailing market conditions, regulatory developments, and technological advancements within the blockchain ecosystem.

Previous recoveries were often catalyzed by specific events—regulatory clarity, institutional adoption milestones, or technological breakthroughs like the Ethereum merge. Investors wondering when Bitcoin and Ethereum prices might stabilize should monitor similar catalysts that could reverse negative sentiment and attract renewed capital inflows.

Trading Strategies During Cryptocurrency Market Downturns

Risk Management When Bitcoin and Ethereum Prices Tumble

Protecting capital during periods when Bitcoin and Ethereum prices tumble requires disciplined risk management strategies. Experienced traders emphasize the importance of position sizing, ensuring no single trade represents an outsized portion of one’s portfolio. Stop-loss orders—predetermined price levels at which positions are automatically closed—can prevent catastrophic losses during rapid declines.

Crypto trading strategies for bear markets differ significantly from bull market approaches. Dollar-cost averaging—systematically purchasing fixed amounts regardless of price—allows investors to accumulate assets gradually without attempting to time the market bottom perfectly. This strategy reduces the psychological pressure of making lump-sum investments during volatile periods.

Identifying Buying Opportunities in the Crypto Crash

While many investors panic when Bitcoin and Ethereum prices tumble, seasoned market participants recognize that substantial declines often create attractive entry points for long-term positions. Identifying genuine buying opportunities requires distinguishing between “catching a falling knife” and acquiring fundamentally sound assets at temporary discounts.

Cryptocurrency investment strategies during downturns should focus on assets with strong fundamentals—active development teams, real-world utility, robust network security, and growing adoption metrics. Both Bitcoin and Ethereum possess these characteristics, making them potentially attractive for investors with sufficient risk tolerance and long-term investment horizons.

The Role of Leverage and Liquidations in Accelerating Declines

How Overleveraged Positions Amplify Price Crashes

A significant factor in the dramatic tumble of Bitcoin and Ethereum prices involves the cryptocurrency derivatives market. Many traders use leverage—borrowing capital to amplify position sizes—which can multiply both gains and losses. When prices decline, leveraged positions face margin calls, forcing traders to either add capital or accept liquidation.

Crypto leverage liquidations create a cascading effect during sharp downturns. As prices fall, liquidation engines automatically close underwater positions, generating additional selling pressure that drives prices lower. This triggers more liquidations in a vicious cycle that can accelerate declines far beyond what fundamental factors alone would justify.

Recent data shows that hundreds of millions of dollars in leveraged positions were liquidated within 24 hours as Bitcoin and Ethereum prices tumbled below critical thresholds. These forced liquidations disproportionately affect long positions—traders betting on price increases—creating intense short-term selling pressure that exacerbates market volatility.

Lessons About Responsible Trading Practices

The current crypto market crash reinforces important lessons about responsible trading practices. Excessive leverage magnifies risk exponentially, potentially wiping out entire accounts during volatile periods. Financial advisors consistently recommend that cryptocurrency investors limit leverage use or avoid it entirely, especially during uncertain market conditions.

Understanding liquidation mechanics helps traders appreciate the additional risks inherent in derivatives trading. When Bitcoin and Ethereum prices tumble, even temporarily, leveraged positions can be closed automatically, preventing traders from benefiting from subsequent recoveries. This reality underscores the advantage of spot trading—purchasing actual cryptocurrencies without leverage—for investors focused on long-term wealth accumulation rather than short-term speculation.

Expert Predictions: Where Are Bitcoin and Ethereum Headed?

Analyst Perspectives on the Cryptocurrency Price Trajectory

Market analysts offer diverse perspectives on future price action as Bitcoin and Ethereum prices tumble toward technical and psychological support levels. Some experts believe the current decline represents a healthy correction that will establish a stronger foundation for future growth. They point to strong fundamental developments—including Ethereum’s successful transition to proof-of-stake and Bitcoin’s growing adoption as a treasury asset—as reasons for long-term optimism.

Conversely, bearish analysts argue that cryptocurrency prices may face additional downward pressure before finding sustainable support. They cite continued macroeconomic headwinds, regulatory uncertainties, and technical breakdowns as evidence that the market hasn’t yet reached capitulation—the point of maximum pessimism that historically marks cycle bottoms.

Technical Price Targets and Support Zones

Technical analysts identify several critical price levels that could determine whether Bitcoin and Ethereum prices tumble further or establish a bottom. For Bitcoin, major support zones exist at psychological levels that previously served as resistance during earlier cycles. Breaking these supports could trigger additional declines toward even lower price targets.

Ethereum price predictions similarly depend on whether the cryptocurrency maintains key support levels identified through technical analysis. Fibonacci retracement levels—mathematical ratios that traders use to identify potential reversal points—suggest several areas where buying pressure might emerge to halt the decline.

Long-Term Implications for Blockchain Technology and Adoption

Separating Price Volatility from Technological Progress

While Bitcoin and Ethereum prices tumble in the short term, the underlying blockchain technology continues advancing regardless of market sentiment. Development activity on both networks remains robust, with thousands of developers building applications, improving protocols, and expanding ecosystem capabilities.

Blockchain technology adoption progresses independently of price action, driven by the technology’s inherent advantages—decentralization, transparency, immutability, and permissionless innovation. Enterprises continue exploring blockchain solutions for supply chain management, digital identity, financial services, and numerous other applications where the technology offers genuine utility.

The Maturation of Cryptocurrency Markets

Each cycle of boom and bust contributes to cryptocurrency market maturation. Improved infrastructure, more sophisticated institutional participation, clearer regulatory frameworks, and enhanced security measures emerge from these periodic stress tests. While price volatility creates challenges for investors, it also facilitates the evolution toward more stable and efficient markets.

The current period, when Bitcoin and Ethereum prices tumble, will likely be remembered as another chapter in cryptocurrency’s ongoing maturation process. Historical patterns suggest that markets emerge stronger after these corrections, with weaker projects failing while fundamentally sound assets survive and eventually thrive.

Regulatory Developments and Their Impact on Cryptocurrency Prices

Global Regulatory Landscape Evolution

Regulatory developments significantly influence Bitcoin and Ethereum prices, with government actions creating both headwinds and tailwinds for digital assets. Recent months have seen increased regulatory activity worldwide, with some jurisdictions moving toward comprehensive cryptocurrency frameworks while others impose restrictive measures.

The crypto regulation impact varies by region. Progressive regulatory approaches in jurisdictions like Switzerland, Singapore, and the United Arab Emirates create favorable environments for blockchain innovation and cryptocurrency adoption. Conversely, restrictive policies in other regions generate uncertainty that contributes to price volatility and capital flight to more welcoming jurisdictions.

Upcoming Policy Decisions to Watch

Several pending regulatory decisions could significantly impact whether Bitcoin and Ethereum prices tumble further or stabilize. Proposed legislation regarding cryptocurrency taxation, securities classification, and exchange oversight will shape market dynamics for years to come. Investors should monitor these developments closely, as regulatory clarity—whether favorable or restrictive—typically reduces uncertainty premium embedded in cryptocurrency valuations.

Cryptocurrency policy changes anticipated in the coming months include potential spot Bitcoin ETF approvals, stablecoin regulations, and DeFi oversight frameworks. Each of these developments carries significant implications for market structure, liquidity, and investor access to digital assets.

Alternative Cryptocurrencies in the Current Market Environment

How Altcoins Perform When Major Cryptos Decline

When Bitcoin and Ethereum prices tumble, alternative cryptocurrencies typically experience amplified volatility. The altcoin market performance during bearish periods generally falls into two categories: assets with strong fundamentals that decline but maintain relative strength, and speculative tokens that experience catastrophic losses as liquidity evaporates.

Quality altcoins with genuine utility, active development communities, and real-world adoption tend to outperform purely speculative assets during market downturns. Projects solving actual problems—such as layer-2 scaling solutions, decentralized finance protocols with proven product-market fit, and blockchain platforms with growing developer ecosystems—demonstrate resilience compared to meme coins and projects lacking substantive value propositions.

Diversification Strategies in Cryptocurrency Portfolios

Portfolio diversification becomes especially important when Bitcoin and Ethereum prices tumble alongside broader market weakness. While Bitcoin and Ethereum typically represent core holdings in cryptocurrency portfolios due to their liquidity and established track records, allocation to carefully selected altcoins can provide exposure to different risk-return profiles.

Crypto portfolio management during bear markets requires balancing risk across different asset categories. Some investors maintain larger Bitcoin and Ethereum allocations while limiting exposure to higher-risk altcoins. Others use market downturns to accumulate positions in promising projects at discounted valuations, accepting higher volatility in exchange for potentially superior long-term returns.

Psychological Aspects of Investing During Cryptocurrency Crashes

Emotional Discipline and Investment Decision-Making

Perhaps the most significant challenge when Bitcoin and Ethereum prices tumble involves managing emotional responses that can lead to poor investment decisions. Fear and panic drive many investors to sell at precisely the wrong time—near market bottoms—while greed and euphoria cause buying at market tops. Developing emotional discipline represents a critical skill for successful long-term cryptocurrency investing.

Crypto investor psychology during downturns separates successful investors from those who consistently underperform. Behavioral finance research demonstrates that humans naturally feel losses approximately twice as intensely as equivalent gains, creating psychological pressure to exit positions during declines even when fundamental analysis suggests holding or accumulating additional exposure.

Building Conviction Through Research and Education

Maintaining conviction when Bitcoin and Ethereum prices tumble requires thorough research and education about the assets held in one’s portfolio. Investors who understand the technology, value proposition, competitive advantages, and growth potential of their cryptocurrency holdings can weather volatility more confidently than those investing based on speculation or social media hype.

Cryptocurrency education empowers investors to make informed decisions independent of market sentiment. Understanding blockchain fundamentals, tokenomics, network security models, and adoption metrics provides the knowledge foundation necessary for evaluating whether price declines represent genuine deterioration in value or temporary market inefficiency, creating opportunity.

The Future of Bitcoin and Ethereum: Beyond the Current Decline

Innovation and Development Roadmaps

Despite periods when Bitcoin and Ethereum prices tumble, both networks continue progressing according to their development roadmaps. Bitcoin’s Lightning Network expansion improves transaction throughput and reduces fees, addressing scalability concerns while maintaining the base layer’s security and decentralization. These technical improvements enhance Bitcoin’s utility as both a store of value and medium of exchange.

Ethereum development roadmap includes several transformative upgrades beyond the successful merge to proof-of-stake. The implementation of sharding will dramatically increase network capacity, while improvements to the Ethereum Virtual Machine enhance developer experience and smart contract functionality. These technical advancements position Ethereum to scale sufficiently for global adoption across diverse use cases.

Institutional Adoption Trajectories

Long-term cryptocurrency adoption trends suggest that institutional involvement will continue expanding despite short-term price volatility. Major financial institutions have established cryptocurrency trading desks, custody solutions, and investment products, creating infrastructure that facilitates broader participation. This institutional scaffolding persists regardless of whether Bitcoin and Ethereum prices tumble temporarily, supporting the thesis that digital assets represent a permanent component of global financial markets.

The adoption of Bitcoin as a reserve asset by corporate treasuries, although still limited, represents another development with long-term implications. As more companies follow pioneering organizations in allocating portions of their balance sheets to Bitcoin, the cryptocurrency’s legitimacy as a store of value strengthens, potentially supporting higher valuations over time.

Conclusion

As Bitcoin and Ethereum prices tumble toward three-month lows, investors face critical decisions about positioning their portfolios for both current conditions and future opportunities. This cryptocurrency market downturn reflects a confluence of factors—regulatory pressures, macroeconomic headwinds, technical breakdowns, and overleveraged positions creating cascading liquidations. Understanding these dynamics provides essential context for making informed investment decisions during volatile periods.

History demonstrates that cryptocurrency markets move in cycles, with bear markets inevitably followed by recoveries and new all-time highs. While past performance doesn’t guarantee future results, the pattern of innovation, adoption growth, and market maturation suggests that fundamentally sound projects like Bitcoin and Ethereum will likely survive and eventually thrive beyond current challenges.

Read more: Ethereum Price Rise 2024 and Possible Parabola.