The Bitcoin price prediction 2025 debate has intensified dramatically, with Bloomberg Intelligence’s Mike McGlone forecasting a severe reversion to $10,000 while legendary trader Peter Brandt warns of an impending 80% parabolic collapse. These conflicting forecasts have sent shockwaves through the digital asset community, leaving investors scrambling to understand which scenario carries more weight. As Bitcoin continues demonstrating extreme volatility characteristics, understanding these expert perspectives becomes crucial for anyone holding or considering positions in the world’s largest cryptocurrency. The divergence between these two analytical giants represents more than mere disagreement—it highlights fundamental questions about Bitcoin’s valuation methodology, market maturity, and long-term sustainability as an investment vehicle.

Mike McGlone’s $10,000 Bitcoin Reversion Theory

The Bloomberg Intelligence senior commodity strategist bases his $10,000 target on several interconnected factors. McGlone points to historical precedent where Bitcoin has repeatedly experienced corrections exceeding seventy percent following major bull runs. His quantitative models identify $10,000 as a critical support level that corresponds with long-term moving averages and represents a psychological anchor for institutional investors who entered positions during previous market cycles.

McGlone’s framework incorporates macroeconomic headwinds that extend beyond cryptocurrency-specific factors. He emphasizes tightening monetary policy, rising real interest rates, and diminishing liquidity conditions that historically punish speculative assets. According to his analysis, Bitcoin functions primarily as a risk-on asset despite narratives positioning it as digital gold or an inflation hedge. When broader financial markets contract under restrictive Federal Reserve policies, McGlone argues that cryptocurrency market volatility intensifies disproportionately.

The commodities expert also highlights declining correlation benefits that initially attracted institutional capital. As Bitcoin’s movements increasingly mirror traditional equity markets—particularly technology stocks—the diversification argument weakens considerably. McGlone contends this correlation convergence eliminates a primary investment thesis supporting higher valuations, particularly when coupled with Bitcoin’s lack of cash flow generation or intrinsic yield mechanisms.

Furthermore, McGlone’s bearish Bitcoin price prediction 2025 incorporates concerns about regulatory tightening across major jurisdictions. He observes that governmental authorities worldwide are developing frameworks that could restrict cryptocurrency adoption, limit use cases, and impose compliance burdens that undermine the decentralized ethos attracting early adopters. These regulatory pressures, combined with environmental concerns surrounding proof-of-work mining, create fundamental headwinds that justify substantial downward price adjustments.

Examining Peter Brandt’s 80% Parabolic Drop Warning

The legendary chartist emphasizes that parabolic advances create unsustainable valuation disconnects from any rational pricing mechanism. When assets experience such rapid appreciation, participant psychology shifts from investment consideration to pure speculation. Brandt argues this psychological transition creates fragile market structures where minor catalysts trigger cascading liquidations. The cryptocurrency technical analysis perspective suggests Bitcoin’s recent behavior fits these dangerous criteria precisely.

Brandt’s historical analysis reveals that previous Bitcoin parabolas concluded with drawdowns ranging from eighty to ninety-four percent. He notes the 2017 peak followed by an eighty-four percent decline, the 2013 surge ending with an eighty-seven percent correction, and earlier cycles demonstrating similar patterns. According to Brandt’s pattern recognition methodology, the current market cycle exhibits even more extreme characteristics than previous parabolic formations, suggesting comparable or potentially more severe retracements.

The technical analyst also incorporates volume analysis and momentum indicators supporting his bearish outlook. Brandt observes declining volume during recent price advances, suggesting weakening buying conviction despite higher prices. This divergence between price and volume traditionally signals exhaustion phases preceding major reversals. Additionally, momentum oscillators show bearish divergences where indicators fail confirming new price highs, creating technical warning signals that experienced traders recognize as distribution patterns.

Brandt’s Bitcoin market crash prediction doesn’t specify exact timing but emphasizes probability and risk management. He acknowledges that parabolic moves can extend further than rational analysis suggests, driven by momentum and speculation. However, his historical pattern studies indicate that once parabolic structures break—typically marked by decisive moves below key moving averages—subsequent declines accelerate rapidly as leveraged positions unwind and panic selling overwhelms demand.

Comparing Fundamental Versus Technical Analysis Approaches

Conversely, Brandt’s technical analysis methodology largely dismisses fundamental considerations, instead focusing exclusively on price action, volume patterns, and historical behavioral precedents. Technical analysts argue that all fundamental information ultimately manifests through price movements, making direct price pattern analysis more efficient and reliable than attempting to quantify countless variables affecting asset valuations. This philosophical divide explains why two respected analysts can reach dramatically different conclusions while both presenting logically consistent arguments.

Fundamental analysis proponents like McGlone would argue that Bitcoin’s lack of cash flows, earnings, or intrinsic utility makes traditional valuation frameworks challenging but not impossible. They attempt comparing Bitcoin against monetary metals, estimating network value based on user adoption, or analyzing on-chain metrics reflecting actual economic activity. These approaches seek establishing rational price ranges supported by measurable data rather than purely speculative sentiment.

Technical analysts counter that markets frequently remain irrational far longer than fundamental analysis predicts, making price pattern recognition more practical for trading and risk management. Brandt’s decades of experience demonstrate that regardless of fundamental justifications, assets exhibiting parabolic characteristics almost invariably experience severe corrections. The cryptocurrency investment strategy debate ultimately centers on whether future-looking fundamentals or historical price patterns provide superior predictive frameworks.

Sophisticated investors recognize value in both approaches, using fundamental analysis for long-term positioning while employing technical analysis for entry timing and risk management. The current Bitcoin price prediction 2025 controversy highlights why diversified analytical frameworks matter—McGlone’s fundamental bearishness and Brandt’s technical warnings both identify significant downside risks through completely different lenses, suggesting elevated caution regardless of methodological preferences.

Historical Bitcoin Market Cycles and Pattern Recognition

Most recently, the 2021 cycle peaked near sixty-nine thousand dollars before declining approximately seventy-seven percent to around fifteen thousand eight hundred dollars in late 2022. Each cycle demonstrates lengthening time frames and diminishing percentage gains, suggesting potential maturation. However, the consistent pattern of extreme drawdowns following parabolic advances supports both McGlone’s mean reversion thesis and Brandt’s technical pattern recognition.

These historical cycles reveal important characteristics relevant to current Bitcoin price prediction 2025 debates. First, Bitcoin has never sustained prices significantly above previous all-time highs without eventually retracing toward prior cycle peaks. Second, each major advance triggers increasingly mainstream participation, creating larger populations of investors purchasing near tops who subsequently experience severe losses. Third, recovery periods extend considerably, often requiring years before establishing new all-time highs.

Pattern recognition also identifies consistent technical signatures across cycles. Parabolic advances typically accelerate in final stages as media coverage intensifies and retail participation surges. Volume patterns show initial accumulation phases with steady buying, distribution phases where smart money exits into retail buying, and finally capitulation phases where cascading stop-loss orders create waterfall declines. The cryptocurrency market analysis framework suggests current conditions exhibit concerning similarities to previous cycle peaks.

However, important differences distinguish the current environment from previous cycles. Institutional adoption has expanded significantly, potentially providing price support absent in earlier periods. Regulatory clarity has improved in certain jurisdictions, reducing some uncertainty. The development of spot Bitcoin exchange-traded funds has created new access channels for traditional investors. Whether these structural changes prevent historical pattern repetition or merely delay inevitable corrections remains the central question dividing analysts.

Macroeconomic Factors Influencing Bitcoin Valuation

Current macroeconomic conditions present stark contrasts to Bitcoin’s formative years. Central banks worldwide have shifted from accommodative to restrictive monetary policies, raising interest rates substantially to combat persistent inflation. Higher interest rates increase opportunity costs for holding non-yielding assets like Bitcoin while simultaneously reducing liquidity available for speculative investments. This fundamental shift challenges the monetary environment that supported previous cryptocurrency bull markets.

Global liquidity conditions have tightened considerably as central banks reduce balance sheets and withdraw stimulus measures implemented during pandemic responses. McGlone emphasizes that Bitcoin historically correlates strongly with global liquidity measures, suggesting that continued monetary tightening creates powerful headwinds regardless of cryptocurrency-specific developments. The quantitative tightening environment reduces speculative capital available for risk assets, potentially triggering the mean reversion McGlone forecasts.

Inflation dynamics also influence Bitcoin valuation debates. Early Bitcoin proponents positioned the cryptocurrency as an inflation hedge comparable to gold, arguing that fixed supply mechanics protect purchasing power during monetary debasement. However, empirical evidence shows Bitcoin behaving more like a risk-on technology asset than an inflation hedge, declining significantly during recent high-inflation periods while rising during disinflationary environments with abundant liquidity.

Geopolitical tensions and financial system instability represent additional macroeconomic variables affecting Bitcoin investment fundamentals. Some analysts argue that banking system concerns, currency devaluation risks, and geopolitical conflicts could drive Bitcoin adoption as an alternative store of value. Conversely, severe economic downturns or systemic crises might force cryptocurrency liquidations as investors raise cash for immediate needs, regardless of long-term conviction.

The employment picture, consumer spending patterns, and corporate earnings also indirectly influence Bitcoin through wealth effects and risk appetite. Strong economic fundamentals typically support speculative investments while economic weakness triggers defensive positioning. Current mixed economic signals—with resilient employment but slowing growth indicators—create uncertainty that complicates Bitcoin valuation modeling and explains divergent expert forecasts.

Technical Indicators Signaling Potential Market Weakness

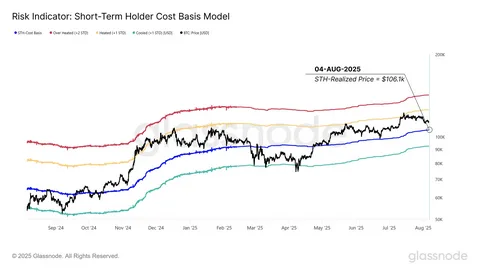

Moving average analysis reveals potential vulnerability in Bitcoin’s technical structure. The relationship between short-term and long-term moving averages traditionally indicates trend strength and sustainability. Recent price action shows narrowing spreads between key moving averages, suggesting diminishing bullish momentum. Should Bitcoin decisively break below critical moving average support levels, technical analysts expect accelerated selling as trend-following systems generate sell signals simultaneously.

Volume analysis presents concerning patterns consistent with distribution phases preceding major declines. The cryptocurrency technical indicators framework emphasizes volume as confirmation of price movements—rising volume during advances confirms buying conviction while declining volume suggests exhaustion. Recent Bitcoin rallies have occurred on diminishing volume, creating divergences that experienced technical analysts recognize as red flags signaling potential trend exhaustion.

Fibonacci retracement analysis identifies key support and resistance levels based on mathematical relationships in price swings. Bitcoin’s current positioning relative to Fibonacci levels from previous major cycles suggests limited upside potential before encountering significant resistance zones. Conversely, Fibonacci support levels that might arrest declines exist considerably below current prices, aligning with both McGlone’s ten thousand dollar target and Brandt’s eighty percent decline scenario.

Chart patterns also support bearish interpretations. Head and shoulders formations, rising wedge patterns, and other reversal structures have appeared across multiple timeframes. While pattern interpretation involves subjectivity, the confluence of multiple bearish patterns across different analytical approaches strengthens the technical case for significant downside risk. These patterns suggest that regardless of fundamental developments, price action itself signals elevated probability of substantial corrections.

Institutional Adoption Impact on Price Stability

Spot Bitcoin exchange-traded funds have attracted billions in assets, creating direct correlation between traditional equity market flows and Bitcoin prices. This institutional infrastructure provides new demand sources potentially supporting prices during corrections. However, ETF structures also enable easier exit for institutional investors, potentially accelerating declines if sentiment shifts. The double-edged nature of institutional adoption complicates predictions about future Bitcoin market volatility patterns.

Corporate treasury adoption represents another structural change affecting Bitcoin’s investment profile. Several publicly-traded companies have allocated portions of corporate treasuries to Bitcoin, treating the cryptocurrency as a strategic reserve asset. These holdings create natural buying pressure and potentially reduce available supply. However, corporate holdings also face shareholder scrutiny and regulatory reporting requirements that could force liquidations during adverse market conditions or negative sentiment shifts.

Institutional custody solutions and regulated trading venues have reduced operational barriers that previously limited professional investor participation. This infrastructure development supports higher absolute price levels by enabling larger capital allocations with appropriate risk management frameworks. Whether institutional adoption provides price floors or merely increases the absolute magnitude of market swings remains debatable among analysts assessing cryptocurrency investment risks.

The derivatives market has expanded substantially, offering institutional investors sophisticated hedging and speculation tools. Options, futures, and structured products enable complex trading strategies that can either stabilize or destabilize underlying spot markets depending on positioning and leverage. The growth of derivatives markets introduces additional complexity to price prediction as leveraged positions can amplify movements in both directions.

Regulatory developments around institutional participation create additional uncertainty. Clearer regulatory frameworks might encourage further institutional adoption, supporting prices. Conversely, restrictive regulations could limit institutional participation or force existing positions to liquidate. The evolving regulatory landscape represents a significant wild card in reconciling McGlone’s and Brandt’s contrasting forecasts.

Regulatory Landscape and Government Policy Implications

United States regulatory agencies have demonstrated increasingly assertive cryptocurrency oversight, with the Securities and Exchange Commission pursuing enforcement actions against major exchanges and cryptocurrency projects. The regulatory approach emphasizes bringing cryptocurrency activities under existing securities laws, potentially constraining innovation and limiting operational flexibility for industry participants. Heightened enforcement creates compliance costs and legal uncertainties that discourage certain types of market participation.

Tax treatment of cryptocurrency transactions affects investor behavior and holding patterns. Many jurisdictions classify cryptocurrency transactions as taxable events, creating reporting burdens and potential liabilities that complicate everyday usage. These tax considerations influence investor decisions about taking profits, rebalancing portfolios, or utilizing cryptocurrencies for transactions rather than speculation. The cryptocurrency regulation impact extends beyond direct prohibitions to encompass friction costs affecting adoption trajectories.

International regulatory coordination efforts aim to standardize cryptocurrency oversight across jurisdictions. Organizations like the Financial Action Task Force promote consistent anti-money laundering standards applicable to cryptocurrency businesses. While regulatory clarity can benefit legitimate market participants, harmonized restrictions could eliminate regulatory arbitrage opportunities that currently support certain cryptocurrency use cases. The balance between consumer protection and innovation remains contentious across different regulatory philosophies.

Central bank digital currency developments represent potential competition affecting Bitcoin’s value proposition. Major economies are exploring or implementing sovereign digital currencies that could provide some cryptocurrency benefits while maintaining government control. Whether CBDCs complement or compete with Bitcoin remains uncertain, but their proliferation could undermine narratives positioning Bitcoin as inevitable future money, supporting more conservative valuation frameworks.

Environmental regulations targeting energy-intensive proof-of-work mining operations could fundamentally alter Bitcoin’s operational economics. Certain jurisdictions have restricted or banned cryptocurrency mining due to energy consumption concerns and carbon footprint considerations. Should major mining regions implement prohibitive regulations, Bitcoin’s security model could face challenges while operational costs increase, potentially justifying lower equilibrium prices than previously sustainable.

Alternative Scenarios and Bullish Counterarguments

Network effect dynamics favor assets achieving critical adoption thresholds, creating self-reinforcing value propositions that justify higher equilibrium prices. Bitcoin’s expanding user base, increasing merchant acceptance, and growing mindshare among younger demographics suggest network effects may support sustained premium valuations. The Bitcoin adoption rate trajectory indicates continued expansion despite price volatility, potentially validating higher long-term price targets than bear cases acknowledge.

Technological developments improving Bitcoin’s scalability, transaction speed, and energy efficiency could expand use cases beyond speculation and store of value functions. Lightning Network adoption, Taproot implementation, and other protocol improvements address previous limitations that restricted Bitcoin’s utility. Should technological advances enable mainstream payment functionality or smart contract capabilities, fundamental valuation frameworks might justify significantly higher prices than current levels.

Geopolitical instability and fiat currency concerns could accelerate Bitcoin adoption in regions experiencing monetary crises or authoritarian financial controls. Countries facing hyperinflation, capital controls, or banking system instability demonstrate elevated cryptocurrency adoption rates. Should global political or economic instability increase, Bitcoin could benefit from safe-haven demand regardless of technical patterns suggesting overbought conditions.

Generational wealth transfer represents a demographic tailwind potentially supporting Bitcoin prices over multi-year horizons. Younger generations demonstrate substantially higher cryptocurrency ownership rates and favorable sentiment compared to older cohorts. As wealth transfers from baby boomers to millennials and Generation Z, asset allocation shifts could direct significant capital toward cryptocurrencies, providing structural demand supporting higher valuations.

The supply dynamics created by Bitcoin’s halving schedule and lost coins create deflationary pressure that could overwhelm selling pressure if demand remains constant or increases. With approximately nineteen million of twenty-one million total Bitcoins already mined and significant portions permanently lost or held by long-term believers, available supply for new investors remains constrained. This supply scarcity could support prices even amid macroeconomic headwinds or technical concerns.

Risk Management Strategies for Bitcoin Investors

Diversification across multiple cryptocurrencies, asset classes, and strategies reduces concentration risk inherent in single-asset exposure. While Bitcoin represents the largest and most established cryptocurrency, alternative digital assets offer different risk-return profiles and correlation characteristics. Traditional asset exposure to stocks, bonds, real estate, and commodities provides ballast during cryptocurrency bear markets. Diversified portfolios smooth volatility and reduce dependence on correct predictions about any single asset’s trajectory.

Dollar-cost averaging strategies reduce timing risk by systematically purchasing assets across different price levels rather than attempting to identify optimal entry points. Regular fixed-amount purchases naturally acquire more units during price declines and fewer during rallies, averaging purchase prices over time. This disciplined approach removes emotional decision-making and reduces the impact of unfortunate timing when lump-sum investing near market peaks.

Hedging strategies using options or futures contracts allow maintaining spot positions while purchasing downside protection. Put options provide insurance against price declines at predetermined levels, similar to insurance policies protecting other valuable assets. While hedging strategies involve costs that reduce returns during favorable markets, they provide peace of mind and capital preservation during adverse scenarios. Sophisticated investors balance hedging costs against risk tolerance and conviction levels.

Regular portfolio rebalancing enforces disciplined profit-taking and loss limitation by maintaining target allocation percentages. When Bitcoin appreciates significantly, rebalancing sells portions returning allocation to target levels, systematically taking profits during strength. Conversely, rebalancing purchases more during declines, averaging down purchase prices. This counter-cyclical approach prevents portfolios from becoming dangerously concentrated in assets experiencing extended rallies.

Conclusion

The coming months will test whether Bitcoin’s institutional adoption and maturing market structure can withstand macroeconomic headwinds and technical warning signals flashing across multiple indicators. The resolution of this debate carries profound implications not just for Bitcoin holders but for the entire cryptocurrency ecosystem’s credibility and long-term viability. Whether McGlone’s fundamental pessimism or Brandt’s technical pattern recognition proves more prescient, investors must prepare for continued volatility and potential severe downside scenarios while remaining open to alternative outcomes.

Understanding the Bitcoin price prediction 2025 debate ultimately matters less than developing personal risk tolerance frameworks, implementing appropriate position sizing, and maintaining discipline during inevitable emotional market extremes. Successful cryptocurrency investing requires balancing conviction against humility, maintaining exposure against protecting capital, and staying informed while avoiding paralysis from information overload. As Bitcoin continues its volatile journey, those prioritizing risk management over prediction will likely achieve better long-term outcomes regardless of which expert forecast proves more accurate.

Take action now by reviewing your current Bitcoin exposure, implementing appropriate risk management strategies, and staying informed about ongoing market developments. Whether you align more with McGlone’s bearish fundamentals or maintain bullish conviction despite technical warnings, ensure your portfolio positioning reflects genuine risk tolerance rather than speculative hope. The Bitcoin price prediction 2025 landscape demands vigilance, flexibility, and disciplined execution—qualities that separate successful investors from casualties of market extremes.

See more: Bitcoin price prediction 2025 analysis reveals conflicting signals.