The cryptocurrency market never sleeps, and neither does the speculation surrounding Bitcoin price prediction. As we navigate through 2025, investors worldwide are asking the same burning question: where is BTC heading next? With Bitcoin’s notorious volatility and its position as the flagship cryptocurrency, understanding potential price movements has become crucial for both seasoned traders and newcomers alike. This comprehensive Bitcoin price prediction analysis will explore technical indicators, market sentiment, institutional adoption, and regulatory developments to provide you with actionable insights into Bitcoin’s future trajectory. Whether you’re considering entering the market or adjusting your existing position, this detailed forecast will equip you with the knowledge needed to make informed decisions in the ever-evolving world of digital assets.

Current Bitcoin Market Analysis and Price Overview

Before diving into Bitcoin price prediction scenarios, it’s essential to understand where BTC stands today. Bitcoin has experienced remarkable resilience throughout its history, recovering from multiple bear markets and consistently establishing new paradigms in the financial landscape. The current market environment reflects a maturing asset class that’s increasingly influenced by macroeconomic factors, institutional participation, and technological developments.

The cryptocurrency king has demonstrated significant price action over recent months, with trading volumes indicating sustained interest from both retail and institutional investors. Market capitalization continues to dominate the crypto space, accounting for approximately 40-50% of the total cryptocurrency market cap. This dominance factor plays a crucial role in overall market sentiment and directly impacts altcoin performance.

Key Factors Influencing Bitcoin’s Current Valuation

Multiple variables contribute to BTC price movements in today’s market. Supply dynamics following the 2024 halving event have reduced new Bitcoin issuance to 3.125 BTC per block, creating a deflationary pressure that historically correlates with bullish price action. Mining difficulty adjustments, hash rate distribution, and miner profitability all feed into the complex equation determining Bitcoin’s fair value.

Network fundamentals remain strong, with on-chain metrics showing healthy transaction volumes, active addresses, and exchange flows. The balance between coins held on exchanges versus those moved to cold storage provides valuable insights into investor conviction and long-term holding patterns.

Technical Analysis for Bitcoin Price Prediction

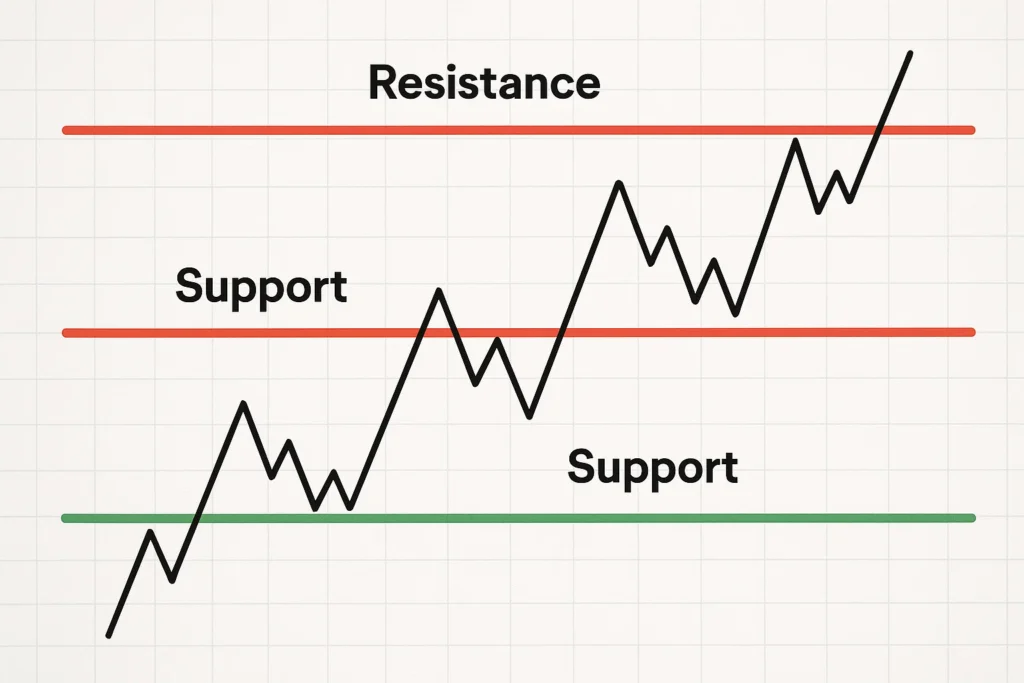

Technical analysis forms the backbone of short-to-medium term Bitcoin price prediction strategies. Chart patterns, support and resistance levels, and momentum indicators offer traders quantifiable data points for decision-making. Currently, Bitcoin’s price structure reveals several critical levels that will likely determine the next significant move.

Moving Averages and Trend Indicators

The 50-day and 200-day moving averages serve as essential trend indicators for BTC price direction. When Bitcoin trades above both these moving averages, it typically signals a bullish market structure. Conversely, trading below these levels often indicates bearish momentum. The relationship between these moving averages—particularly the formation of a “golden cross” (50-day crossing above 200-day) or “death cross” (50-day crossing below 200-day)—has historically preceded major price movements.

The Relative Strength Index (RSI) provides momentum insights, identifying overbought conditions above 70 and oversold conditions below 30. Bitcoin’s RSI readings in various timeframes help traders assess whether the current price represents a sustainable trend or an overextended move due for correction.

Support and Resistance Levels

Identifying key support and resistance zones is fundamental to any Bitcoin price prediction framework. Psychological price levels ending in round numbers often act as significant barriers, creating clustering of buy and sell orders. Historical price action at these levels determines their strength, with repeated tests typically reinforcing their importance.

Fibonacci retracement levels derived from previous significant price swings provide mathematically-based support and resistance zones. The 0.382, 0.5, and 0.618 retracement levels frequently align with actual price reversals, offering traders precise entry and exit points for their positions.

Fundamental Factors Driving Bitcoin Price Prediction

Beyond technical analysis, fundamental factors create the underlying narrative for Bitcoin price prediction over longer timeframes. These macroeconomic and crypto-specific developments shape the environment in which Bitcoin operates and ultimately influence its valuation.

Institutional Adoption and Investment Flows

The landscape of institutional Bitcoin adoption has transformed dramatically. Major financial institutions, corporations, and investment funds now allocate portions of their portfolios to Bitcoin, treating it as “digital gold” or a hedge against inflation. The approval of spot Bitcoin ETFs has opened floodgates for traditional investors who previously lacked access to cryptocurrency markets through conventional brokerage accounts.

Corporate treasury allocation represents another significant trend, with companies holding Bitcoin on their balance sheets as a treasury reserve asset. This institutional accumulation removes supply from circulation, creating upward pressure on the BTC price as demand continues growing while available supply decreases.

Regulatory Developments and Legal Framework

Regulatory clarity significantly impacts Bitcoin price prediction scenarios. Progressive regulatory frameworks in major economies provide legitimacy and reduce uncertainty, encouraging broader adoption. Conversely, restrictive policies or regulatory crackdowns can temporarily suppress prices and slow adoption rates.

The ongoing dialogue between cryptocurrency industry leaders and government regulators worldwide shapes the legal landscape. Countries establishing clear guidelines for cryptocurrency taxation, trading, and custody create favorable environments for institutional participation and mainstream adoption.

Bitcoin Halving Impact on Price Prediction

The Bitcoin halving event, occurring approximately every four years, reduces mining rewards by 50% and historically precedes major bull markets. The most recent halving in 2024 cut block rewards to 3.125 BTC, and historical patterns suggest significant price appreciation typically follows 12-18 months post-halving.

Historical Halving Cycles and Price Performance

Previous halving cycles demonstrate consistent patterns worth examining for Bitcoin price prediction. The 2012 halving preceded a rally from roughly $12 to over $1,000. The 2016 halving saw Bitcoin climb from approximately $650 to nearly $20,000. The 2020 halving initiated a bull run culminating in prices exceeding $69,000 in 2021.

While past performance doesn’t guarantee future results, the fundamental supply-demand dynamics created by halvings remain unchanged. Reduced new supply entering the market combined with steady or increasing demand mathematically supports price appreciation over time.

Bitcoin Price Prediction: Short-Term Outlook (2025)

For the remainder of 2025, Bitcoin price prediction models suggest several potential scenarios based on current market conditions and upcoming catalysts. The short-term outlook considers immediate technical factors, upcoming economic events, and cryptocurrency-specific developments.

Bullish Scenario for BTC Price

In an optimistic scenario, Bitcoin could test and potentially break through previous all-time highs, targeting the $80,000-$100,000 range. This scenario assumes continued institutional accumulation, positive regulatory developments, favorable macroeconomic conditions with declining interest rates, and increased mainstream adoption through payment integration and financial products.

Key drivers for this bullish Bitcoin price prediction include sustained ETF inflows, corporate treasury additions, growing adoption in developing nations for remittances and store of value, and technological improvements enhancing Bitcoin’s scalability and utility.

Bearish Scenario for Bitcoin

The bearish case for BTC price involves consolidation or correction to lower support levels, potentially retesting the $40,000-$50,000 range. This scenario might materialize if global economic recession reduces risk appetite, regulatory crackdowns occur in major markets, significant security breaches or technical issues emerge, or macroeconomic policies favor traditional assets over cryptocurrencies.

Risk management remains essential regardless of market outlook. Even within bull markets, Bitcoin experiences corrections of 20-40%, testing investor conviction and creating opportunities for strategic accumulation.

Neutral/Consolidation Scenario

A neutral Bitcoin price prediction suggests extended consolidation within an established range, allowing the market to digest recent gains and build a foundation for the next significant move. This scenario involves sideways price action, decreasing volatility, and accumulation by long-term holders while weak hands exit positions.

Consolidation phases, while frustrating for traders seeking quick profits, historically create sustainable bases for subsequent rallies and reduce the likelihood of severe crashes following parabolic price increases.

Bitcoin Price Prediction: Medium-Term Outlook (2025-2026)

Looking beyond immediate price action, medium-term Bitcoin price prediction incorporates broader adoption trends, technological developments, and evolving market structure. The 2025-2026 timeframe represents a critical period in Bitcoin’s maturation as an asset class.

Adoption Curve and Network Effects

Bitcoin’s value proposition strengthens as network effects compound. Each new user, business, or institution adopting Bitcoin increases the network’s utility and value. The adoption curve suggests accelerating growth as cryptocurrency infrastructure improves, user experience simplifies, and education spreads.

Payment integration through established financial networks, lightning network expansion for instant transactions, and improved custody solutions for institutions all contribute to this medium-term BTC price outlook. As Bitcoin becomes easier to use and more widely accepted, demand naturally increases, supporting higher valuations.

Competition and Market Share Considerations

While Bitcoin maintains a dominant market position, competition from alternative cryptocurrencies impacts its price prediction. Ethereum’s smart contract platform, stablecoins for transactions, and newer blockchain projects with advanced features all compete for investor attention and capital allocation.

However, Bitcoin’s first-mover advantage, network security, brand recognition, and simplicity of purpose as digital gold provide substantial moats against competitors. The medium-term outlook suggests Bitcoin will maintain its position as the primary cryptocurrency for store-of-value applications.

Bitcoin Price Prediction: Long-Term Outlook (2027-2030)

Long-term Bitcoin price prediction ventures into more speculative territory but relies on fundamental principles of scarcity, adoption, and monetary theory. The 2027-2030 timeframe could witness Bitcoin’s evolution into a mature asset class comparable to gold or major fiat currencies in terms of market capitalization and global adoption.

Macro Economic Factors and Bitcoin as Digital Gold

Bitcoin’s fixed supply of 21 million coins positions it as an inflation hedge and store of value in an era of monetary expansion. As central banks continue navigating debt levels and inflationary pressures, Bitcoin’s programmatic scarcity becomes increasingly attractive to wealth preservation strategies.

The long-term BTC price trajectory depends significantly on Bitcoin’s success in capturing a meaningful portion of gold’s $13 trillion market cap, real estate’s store of value function, or currency reserves held by nation-states. Even modest market share in these established wealth storage mechanisms suggests valuations substantially higher than current levels.

Technological Evolution and Bitcoin Improvements

Bitcoin’s development continues through protocol upgrades, layer-2 solutions, and ecosystem expansion. The Lightning Network enables instant, low-cost transactions, expanding Bitcoin’s utility beyond a store of value into medium of exchange applications. Taproot and future protocol improvements enhance privacy, efficiency, and smart contract capabilities while maintaining Bitcoin’s core security and decentralization principles.

These technological advancements support long-term Bitcoin price prediction by increasing Bitcoin’s utility and addressing common criticisms regarding scalability and transaction costs. As Bitcoin becomes more functional and accessible, its value proposition strengthens across multiple use cases.

Expert Bitcoin Price Prediction and Market Sentiment

Cryptocurrency analysts, institutional investors, and industry leaders regularly publish Bitcoin price prediction forecasts reflecting their market outlook. While individual predictions vary widely, consensus among experts provides a valuable perspective on potential price trajectories.

Institutional Price Targets

Major financial institutions and investment firms have published remarkably bullish long-term BTC price targets. Some projections suggest Bitcoin could reach $150,000-$250,000 within the next few years, while more aggressive forecasts envision $500,000-$1,000,000 over the next decade as Bitcoin matures into a global reserve asset.

These institutional forecasts typically incorporate scenarios where Bitcoin captures specific percentages of various markets—gold’s market cap, offshore wealth storage, remittances, or emerging market currency substitution. The mathematical frameworks supporting these predictions rely on supply-demand economics and adoption curve modeling.

Retail Sentiment and Market Psychology

Retail investor sentiment significantly influences short-term price action and creates volatility around longer-term trends. The Fear and Greed Index, social media sentiment analysis, and search volume trends provide insights into retail psychology and potential market turning points.

Extreme fear often presents buying opportunities as capitulation selling creates temporary price dislocations, while extreme greed frequently precedes corrections as exuberance drives unsustainable price increases. Monitoring sentiment indicators enhances Bitcoin price prediction accuracy by identifying potential reversal points.

Risk Factors That Could Impact Bitcoin Price Prediction

No Bitcoin price prediction is complete without acknowledging potential risks and challenges that could significantly impact actual outcomes. Understanding these risks enables better preparation and risk management strategies.

Regulatory and Legal Risks

Government actions represent perhaps the most significant risk to Bitcoin’s price trajectory. Outright bans in major economies, restrictive regulations limiting access or use, unfavorable tax treatment discouraging adoption, or increased reporting requirements reducing privacy could all negatively impact BTC price.

However, Bitcoin’s decentralized nature and global accessibility provide resilience against country-specific regulatory actions. Historical evidence suggests that regional restrictions primarily relocate activity rather than eliminate it, with other jurisdictions often welcoming cryptocurrency business and innovation.

Technology and Security Risks

While Bitcoin’s blockchain has operated securely for over 15 years, technological risks persist. Potential threats include quantum computing advances potentially breaking current cryptographic standards, smart contract vulnerabilities in layer-2 solutions, exchange hacks or custody failures eroding confidence, or unforeseen technical issues in protocol upgrades.

The Bitcoin development community actively addresses these risks through ongoing research, careful testing of protocol changes, and progressive implementation of security enhancements. The conservative development approach prioritizes security and decentralization over rapid feature additions.

Market Structure and Manipulation Risks

Cryptocurrency markets, while maturing, remain vulnerable to manipulation due to lower liquidity compared to traditional financial markets. Large holders (“whales”) can significantly impact short-term prices through coordinated buying or selling. Exchange insolvency, market maker failures, or derivative market disruptions could trigger cascade effects impacting Bitcoin price prediction scenarios.

Market maturation, increased liquidity, and institutional participation gradually reduce these risks, but they remain relevant considerations, particularly for short-term traders.

Investment Strategies Based on Bitcoin Price Prediction

Understanding Bitcoin price prediction frameworks enables the development of appropriate investment strategies aligned with individual risk tolerance, time horizon, and financial goals.

Dollar-Cost Averaging Approach

Dollar-cost averaging (DCA) removes timing risk by investing fixed amounts at regular intervals regardless of the BTC price. This strategy particularly suits long-term investors who believe in Bitcoin’s fundamental value proposition but acknowledge the difficulty of timing market entry perfectly.

DCA smooths out volatility’s impact, accumulating more Bitcoin when prices are low and less when prices are high, resulting in favorable average purchase prices over time. This approach requires discipline and patience, but historically produces strong returns for Bitcoin investors.

Strategic Accumulation During Corrections

More active investors may choose strategic accumulation strategies, identifying price corrections as buying opportunities. This approach requires understanding technical analysis, risk management through position sizing, emotional discipline to buy during fear periods, and patience to wait for optimal entry points.

Strategic accumulation capitalizes on Bitcoin’s volatility, building positions during temporary price weakness while maintaining conviction in long-term Bitcoin price prediction scenarios.

Portfolio Allocation Considerations

Financial advisors increasingly recommend a modest Bitcoin allocation within diversified investment portfolios. Common recommendations suggest 1-5% allocation for conservative investors and up to 10-20% for those with higher risk tolerance and stronger cryptocurrency conviction.

Portfolio allocation should consider individual circumstances, including investment timeline, risk tolerance, overall financial position, and understanding of cryptocurrency markets. Regular rebalancing maintains target allocations as the BTC price fluctuates.

Conclusion

The journey of Bitcoin price prediction combines technical analysis, fundamental research, market psychology, and risk management into a comprehensive investment framework. While pinpointing exact price targets remains impossible, understanding the factors influencing Bitcoin’s value creates a foundation for informed decision-making.

Bitcoin’s unique properties—fixed supply, decentralized network, global accessibility, and growing adoption—support a compelling long-term value proposition. Short-term volatility will continue challenging investor conviction, but historical patterns suggest that patient, informed investors are rewarded for maintaining a long-term perspective.