Bitcoin has gone from being a strange idea in the digital world to one of the most disruptive technologies of the 21st century. Bitcoin was conceived as a decentralized alternative to traditional monetary systems after the global financial crisis of 2008. It has grown into a major power in the economy, technology, and society throughout the years. Understanding Bitcoin’s history, how it works, the regulatory challenges it faces, and its cultural significance can help explain why it continues to draw the world’s attention.

Someone or a group of people using the name Satoshi Nakamoto created Bitcoin in 2008. The whitepaper “Bitcoin: A Peer-to-Peer Electronic Cash System” laid out a plan for a financial system that doesn’t depend on central banks or other financial middlemen. Nakamoto mined the first block of the Bitcoin network in January 2009. He included a message in it that referred to a UK newspaper story regarding bank bailouts. This conduct showed what Bitcoin was all about: giving people a choice other than fiat currencies that are controlled by a central authority and are prone to inflation.

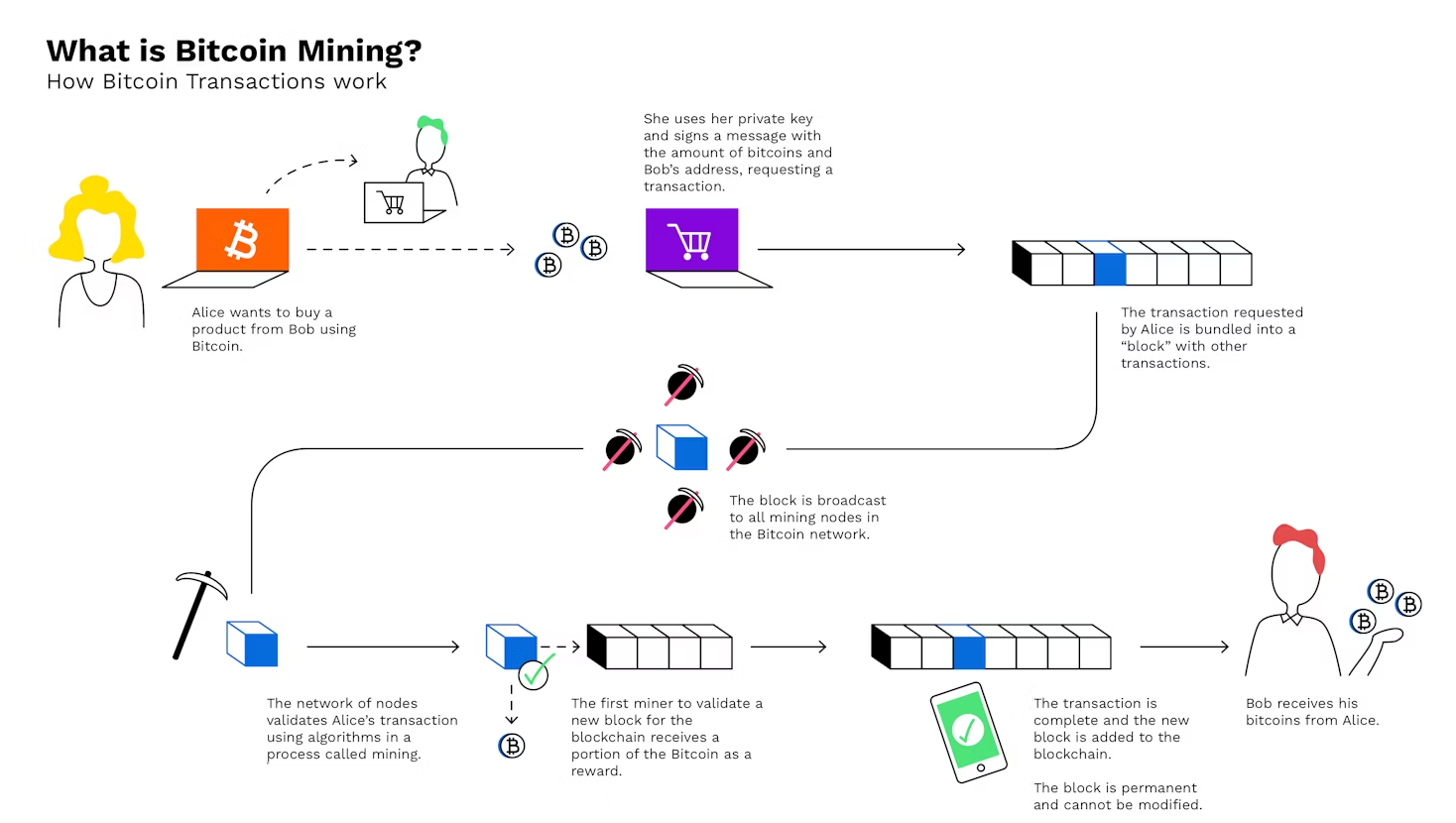

Blockchain is the technology that powers Bitcoin. It is a decentralized ledger that keeps track of transactions on a network of computers. Proof of Work is the name of the mechanism that miners use to check each transaction. They employ computational power to solve cryptographic challenges. Once verified, miners group transactions into blocks and upload them to the blockchain. This procedure makes a clear and unchangeable record of all Bitcoin transfers.

This approach makes sure that people can trust one another without a central authority. Bitcoin’s supply is limited to 21 million coins. The limitation was done on purpose in the code to stop inflationary activities that are typical with fiat currencies. Because of this, people often call Bitcoin “digital gold” because it protects against the devaluation of money and government overreach.

Bitcoin’s economic impact has grown rapidly in the past decade. Now ordinary individuals, fintech companies, and more institutional players are investing in this risky venture. Tesla and MicroStrategy have Bitcoin balance sheets. Traditional financial firms BlackRock and Fidelity now offer Bitcoin investments. In 2024, the US government approved spot Bitcoin ETFs, paving the way for digital assets in finance. Bitcoin’s volatility is always a problem, but institutional support has stabilized its market reputation. Many investors consider Bitcoin a safe long-term investment, especially in times of economic uncertainty, high inflation, and geopolitical unrest.

Different countries have established various regulations regarding Bitcoin. In some places, such as the US, groups like the SEC and CFTC regulate it as a commodity. Regulatory clarity has gotten better in the last several years, especially since Bitcoin ETFs have come out and there has been more talk about protecting consumers and being open about money.

On the other hand, China and other nations have completely banned cryptocurrency trade and mining because they are worried about capital flight and financial instability. El Salvador, on the other hand, made news in 2021 when it became the first country to make Bitcoin legal tender. The goal was to increase financial inclusion and lower remittance expenses. The experiment is still up for dispute, but it shows how important it is in global policy debates.

Bitcoin’s Environmental Impact Debate

People have criticized Bitcoin’s Proof of Work system because it uses a lot of energy. Bitcoin mining’s effect on the environment has prompted a lot of controversy, especially when it comes to climate change goals. Peak energy use was comparable to that of small nations, raising concerns about its longevity.

But the industry is changing. Many mining companies are moving to places where there are a lot of renewable energy sources. Mining farms are currently powered by hydropower, wind, and solar energy. Several projects are looking into more environmentally friendly ways to reach agreement or reduce carbon emissions. The goal of these changes is to make Bitcoin’s growth more environmentally friendly, but there are still problems to solve before sustainability can be achieved on a large scale.

Bitcoin is important for more than just economics and technology; it also helps people get financial freedom. In areas with limited access to banking or unstable local currencies, it provides a safe and borderless way to save and conduct business. ess. Bitcoin has given people in nations like Venezuela, Nigeria, and Ukraine the power to fight hyperinflation, currency controls, and political repression.

Bitcoin is decentralized, which means that people can control their assets without the help of banks, governments, or businesses. But with this power comes the duty to keep digital wallets saunderstandknow how volatile the market is, and deal with legal uncertainty. The rise of decentralized finance (DeFi) makes Bitcoin even more useful by letting people lend, borrow, and trade without going through a middleman.

The Future of Bitcoin

More technological advancements, increased usage, and evolving regulations will likely shape Bitcoin’s future. The Lightning Network and other improvements are fixing scaling problems, which makes microtransactions faster and cheaper. If Bitcoin integrates with e-commerce sites, financial apps, and digital identity systems, it could gain even more significance in the global digital economy.

Bitcoin is a non-sovereign, programmable asset that is independent of state control. Governments are closely examining central bank digital currencies (CBDCs). Bitcoin’s effects are likely to become more complicated and important, whether it is used as an investment, a way to make payments, or a way to gain freedom.

Final thoughts

Bitcoin is a mix of technology, economics, and ideas. It is a way to come up with new ideas, a challenge to traditional ways of doing business, and a sign of the digital age. There will be technical, regulatory, and environmental challenges on the road ahead, but growth is changing the way we think about money, trust, and the future of finance. It is not just a currency; it is a catalyst for transformation in the digital era. age.