Bitcoin Price

Bitcoin price crashed today, sending shockwaves through the investment community. As the world’s leading digital asset plummets below critical support levels, investors are scrambling to understand what’s driving this dramatic sell-off. The Bitcoin price crash has erased months of gains, pushing the cryptocurrency to its lowest levels in seven months and triggering widespread panic among both retail and institutional investors. The Bitcoin crash today requires examining multiple interconnected factors, from massive institutional outflows to deteriorating market sentiment.

What Happened to Bitcoin Price Today?

The cryptocurrency recently dropped below ninety thousand dollars, reaching eighty-nine thousand five hundred dollars for the first time in seven months.

The severity of the Bitcoin price crash today becomes even more apparent when examining the broader market impact. The total crypto market cap suffered a massive one hundred twenty billion dollar drop in the last twenty-four hours, demonstrating that this isn’t just a Bitcoin-specific issue but a wider market correction affecting all digital assets.

Massive Liquidations Trigger Bitcoin Price Crash

One of the primary catalysts behind the Bitcoin price crash today has been unprecedented liquidation events across cryptocurrency markets. Massive liquidations wiped out over one billion dollars today, creating a cascading effect that drove prices even lower.

Liquidations occur when leveraged positions are forcibly closed because traders can no longer meet margin requirements. As Bitcoin’s price declined, thousands of leveraged long positions were automatically liquidated, creating additional selling pressure that pushed prices down further in a devastating feedback loop.

Record-Breaking Bitcoin ETF Outflows

Perhaps the most significant factor contributing to the Bitcoin price crash today has been the unprecedented exodus of capital from Bitcoin exchange-traded funds. BlackRock’s spot Bitcoin ETF recorded a record single-day outflow of five hundred twenty-three point two million dollars on Tuesday, marking the largest withdrawal since the fund launched in January two thousand twenty-four.

The scale of these Bitcoin ETF outflows is truly remarkable. Bitcoin ETFs logged over two billion dollars in weekly outflows, marking their second-worst streak as institutional investors turned cautious. This represents a dramatic reversal from earlier periods when these same ETFs were experiencing consistent inflows that helped propel Bitcoin to new highs.

Weakening Institutional Demand for Bitcoin

Beyond ETF outflows, broader institutional demand for Bitcoin has deteriorated significantly. Long-term holders sold about eight hundred fifteen thousand BTC in thirty days — the most since early two thousand twenty-four — while spot and ETF demand weakened.

This unprecedented selling by long-term holders represents a fundamental shift in market dynamics. These holders, often considered the “strong hands” of the Bitcoin market, had previously been accumulating during price dips. Their decision to sell in such large quantities suggests they’re either taking profits or losing confidence in near-term prospects.

Institutional buying has also dropped below daily mining supply, intensifying sell pressure. This means that the natural inflation from newly mined Bitcoin isn’t being absorbed by institutional buyers as it was during the bull run. Instead, this supply is hitting the market without sufficient demand to support prices.

Federal Reserve Uncertainty and Bitcoin

Macroeconomic factors, particularly uncertainty surrounding Federal Reserve policy, have played a crucial role in the Bitcoin price crash today. This uncertainty over whether the Fed will cut rates in December is likely one of the biggest factors behind Bitcoin’s fall today.

The relationship between Federal Reserve policy and Bitcoin prices has become increasingly pronounced as the cryptocurrency has matured into a mainstream asset class. At the beginning of November, the majority of traders thought there was a ninety per cent chance the Fed would cut rates, but now traders think there is only around a fifty per cent chance.

The current macroeconomic environment presents additional challenges. With inflation concerns persisting and economic data showing mixed signals, the Federal Reserve faces difficult decisions about monetary policy. This uncertainty creates a challenging backdrop for speculative assets like Bitcoin, which tend to thrive during periods of clear monetary easing but struggle when policy direction becomes ambiguous.

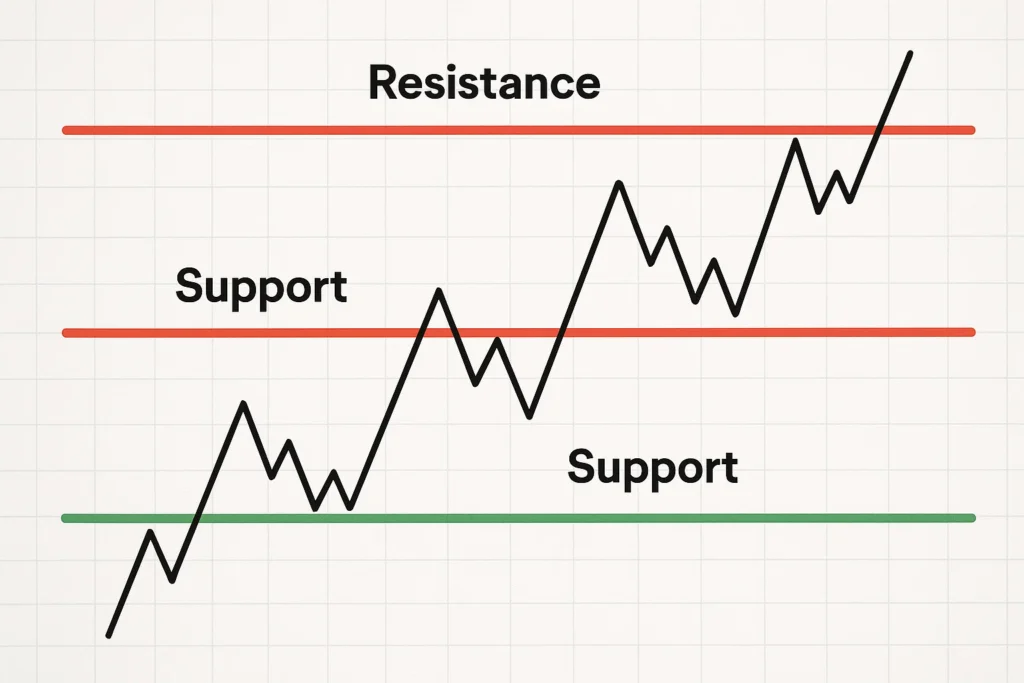

Technical Breakdown and Death Cross

From a technical analysis perspective, the Bitcoin price crash today has been exacerbated by several critical technical breakdowns. The slide accelerated after Bitcoin failed to reclaim key support at ninety-three thousand seven hundred dollars over the weekend, breaking below its two hundred-day moving average and triggering a death cross between the fifty-day and two hundred-day trendlines.

This technical breakdown creates a self-reinforcing cycle. As prices break through support levels, more technical traders turn bearish and either sell existing positions or open short positions. This additional selling pressure pushes prices lower, breaking through more support levels and triggering more technical selling.

Market Sentiment Turns to Extreme Fear

The psychological aspect of the Bitcoin price crash today cannot be overstated. The Crypto Market Fear and Greed Index has slipped to extreme fear at fifteen today, indicating that investor sentiment has reached one of its most pessimistic levels of the entire cycle.

This extreme fear sentiment becomes self-perpetuating as negative sentiment drives selling, which pushes prices lower, which increases fear even more. The Bitcoin Fear and Greed Index has plunged to a new Extreme Fear low, signalling deep market anxiety even as long-term holders stay the course.

Social media and news coverage amplify these sentiment swings. As headlines about the Bitcoin crash proliferate, they reach investors who might not actively follow the market daily, prompting them to check their portfolios and potentially make fear-driven selling decisions.

Government Shutdown Impact on Crypto Markets

An often-overlooked factor contributing to the Bitcoin price crash today relates to the recent U.S. government shutdown. The recent government shutdown caused the Treasury General Account to swell, absorbing liquidity, which had negative implications for risk assets, including Bitcoin.

The government shutdown also delayed important economic reports that investors rely on for making informed decisions. Without clear data on employment, inflation, and economic growth, investors become more risk-averse, preferring to wait on the sidelines rather than commit capital to volatile assets.

Competition from Traditional Markets

Another dimension of the Bitcoin crash involves capital rotation away from cryptocurrencies toward traditional markets. Attention and capital have shifted toward equities in two thousand twenty-five, with big tech and Nasdaq growth stocks soaking up much of the risk appetite that might have flowed into crypto.

Bitcoin reacts more strongly to stock market drops than it does to gains—falling harder on bad equity days than rising on good ones. This “negative skew” is typically seen in bear markets and suggests that Bitcoin is being treated more as a high-risk speculative asset rather than the digital gold narrative that bulls had promoted.

Altcoin Pressure and Broader Market Weakness

The Bitcoin price crash today hasn’t occurred in isolation. The entire cryptocurrency market has experienced severe pressure, with altcoins often suffering even steeper declines. Top and trending altcoins XRP, Binance Coin, Solana, Cardano, Zcash, and AI coins tumbled five to ten per cent over the past twenty-four hours.

Ethereum dropped below three thousand dollars today, and Solana each dropped roughly a third since early October, feeding into a broader one trillion dollar wipeout across the crypto market. This massive wealth destruction has psychological effects that extend beyond individual positions, creating a general sense of crisis in the cryptocurrency community.

Mining Sector Adjustments

The Bitcoin crash has forced adjustments throughout the cryptocurrency ecosystem, including among miners who form a critical part of Bitcoin’s infrastructure. Bitcoin miners appear to be adjusting strategies in response to market volatility, with miners’ thirty-day net BTC position flipping to modest accumulation after recent capital raises in the sector.

However, recent capital raises in the mining sector have provided some firms with financial cushions that allow them to hold rather than immediately sell newly mined Bitcoin. This shift toward accumulation could provide modest support, though it’s unlikely to offset the massive selling pressure from other sources.

JPMorgan analysts say Bitcoin’s current estimated production cost of ninety-four thousand dollars acts as a historical price floor. If this analysis proves correct, current price levels near or below production costs might represent an area where miners would reduce selling or where the market finds support. However, production costs can vary significantly between mining operations, and not all miners have the financial strength to hold during extended downturns.

Options Market Signals Bearish Outlook

Derivatives markets provide additional insights into the Bitcoin price crash today and expectations for future price movements. More than forty-one thousand BTC options worth four billion dollars in notional value expired today on Deribit, with the put-call ratio at zero point seven and the max pain price at one hundred five thousand dollars.

The options market data reveal that traders are positioning for further downside. In the latest twenty-four hours, put volume has exceeded call volume, with a put-call ratio of one point one, signalling traders are hedging to offset losses, expecting BTC to fall below ninety-five thousand dollars.

Trading Volume Decline and Liquidity Issues

The Bitcoin crash has been accompanied by notable changes in trading patterns that have exacerbated price movements. Reduced trading volume and declining liquidity have made the market more susceptible to sharp price swings.

Lower trading volume during declines is particularly concerning because it suggests an absence of buyers willing to step in and support prices. When an asset experiences high-volume selling, it at least indicates active price discovery. Low-volume declines suggest that sellers are willing to accept increasingly lower prices just to exit positions, while buyers remain absent.

Spot average order size metrics show that retail traders are not returning, even as Bitcoin has dropped almost twenty-seven per cent from its October 6th all-time high. Exchange data indicates larger order sizes, highlighting whale activity rather than small-scale retail buyers.

Corporate Bitcoin Holdings Under Pressure

Companies with significant Bitcoin holdings on their balance sheets have experienced particular pressure during the Bitcoin price crash today.

Strategy recently made its largest Bitcoin purchase since mid-summer, acquiring eight thousand one hundred seventy-eight BTC for approximately eight hundred thirty-five point six million dollars at an average price of one hundred two thousand one hundred seventy-one dollars per bitcoin.

Analyst Perspectives on Bitcoin Bottom

As the Bitcoin crash continues, market analysts have offered various perspectives on where prices might find support and what conditions might trigger a recovery. Analysts at Bitfinex say the current bitcoin pullback mirrors past mid-cycle retracements, with the drop from October’s high matching the typical twenty-two per cent drawdown seen throughout the twenty-twenty-three to twenty-twenty-five bull market.

This historical comparison provides some context for the current decline. However, historical patterns don’t always repeat, and each market cycle has unique characteristics.

Impact on Cryptocurrency Stocks

The ripple effects of the Bitcoin price crash today have extended well beyond cryptocurrency markets into traditional equity markets.

These cryptocurrency-related stocks often trade with even higher volatility than Bitcoin itself, amplifying both gains during bull markets and losses during corrections. Mining stocks face particular pressure because their economics depend entirely on Bitcoin prices remaining above production costs.

The poor performance of cryptocurrency stocks creates a feedback loop. As these stocks decline, institutional investors who might have gained cryptocurrency exposure through equities rather than direct Bitcoin purchases see losses that reinforce negative sentiment about the entire sector.

Whale Accumulation vs. Retail Absence

Despite the Bitcoin crash, an interesting dynamic has emerged in terms of who is buying and who is selling. Whales bought in, including a thirty-one point one six million ETH purchase in one day, while retail investors have avoided the downturn.

This divergence between whale accumulation and retail absence is significant. Whales—individuals or entities holding large amounts of cryptocurrency—are often more sophisticated investors with longer time horizons. Their willingness to buy during the downturn suggests some level of confidence that current prices represent value.

Thirty-day permanent holder demand is showing record accumulation during the price selloff. This data indicates that some category of investors is viewing the current decline as a buying opportunity rather than a reason to panic.

Historical Context and Market Cycles

Bitcoin price crash today requires placing it within the context of Bitcoin’s historical price cycles. Bitcoin’s current slide from its early October record of one hundred twenty-six thousand dollars ranks among the steepest forty-three-day drawdowns since twenty seventeen.

Bitcoin has experienced numerous boom-and-bust cycles throughout its history. Previous bull markets have all been followed by significant corrections, with drawdowns of fifty to eighty per cent being common. While the current decline is severe, it’s not unprecedented within Bitcoin’s historical volatility profile.

The question facing investors now is whether this correction represents a temporary setback within an ongoing bull market or the beginning of a new bear market. Bull market corrections typically see Bitcoin retrace twenty-five to forty per cent before resuming upward trends, while bear markets involve much deeper and more prolonged declines.

Geopolitical and Trade Tensions

The Bitcoin crash has also been influenced by broader geopolitical developments that have affected risk asset sentiment globally.

Trade tensions create general economic uncertainty that makes investors more risk-averse across all asset classes. When major economies engage in trade disputes, the potential for slower global economic growth increases, which typically leads to reduced appetite for speculative assets like cryptocurrencies.

The specific impact on Bitcoin is multifaceted. Indirect effects include general risk-off sentiment that causes investors to reduce exposure to volatile assets regardless of their specific characteristics.

Path to Recovery: What Needs to Change

For Bitcoin to recover from the current crash, several conditions would likely need to improve. First and most importantly, the flow dynamics in Bitcoin ETFs would need to stabilise and eventually reverse. As long as massive outflows continue from products like BlackRock’s IBIT, sustained recovery will remain difficult.

Second, clarity around Federal Reserve policy would help. If the Fed provides clear signals about future rate cuts and economic conditions stabilise, risk appetite could return to markets. With the government reopening, more liquidity injected into the system will benefit Bitcoin’s dollar price in the near term.

Long-Term Fundamentals vs. Short-Term Volatility

Despite the severity of the Bitcoin price crash today, some analysts argue that long-term fundamentals remain intact. Major financial institutions, including JPMorgan, now accept Bitcoin as collateral for loans despite its price weakness, and this evolving infrastructure offers more support compared to previous bearish cycles.

The infrastructure supporting Bitcoin has indeed matured significantly compared to previous cycles. Regulated custody solutions, derivatives markets providing hedging tools, ETF products offering easy access, and growing institutional acceptance all represent fundamental improvements to the Bitcoin ecosystem that transcend short-term price movements.

Conclusion

The Bitcoin price crash today results from a complex interplay of factors, including record ETF outflows, deteriorating institutional demand, macroeconomic uncertainty, technical breakdowns, and evaporating market sentiment. No single factor can fully explain the severity of the decline; rather, it’s the convergence of multiple negative catalysts that has created the current crisis.

For investors trying to navigate this turbulence, several key points emerge. Second, the current drawdown, while severe, falls within historical parameters for Bitcoin corrections. Third, the absence of retail participation and continued whale accumulation creates an interesting dynamic that could resolve in either direction.

Read more: Bitcoin Price Crash Today Will BTC Drop Below $70,000?