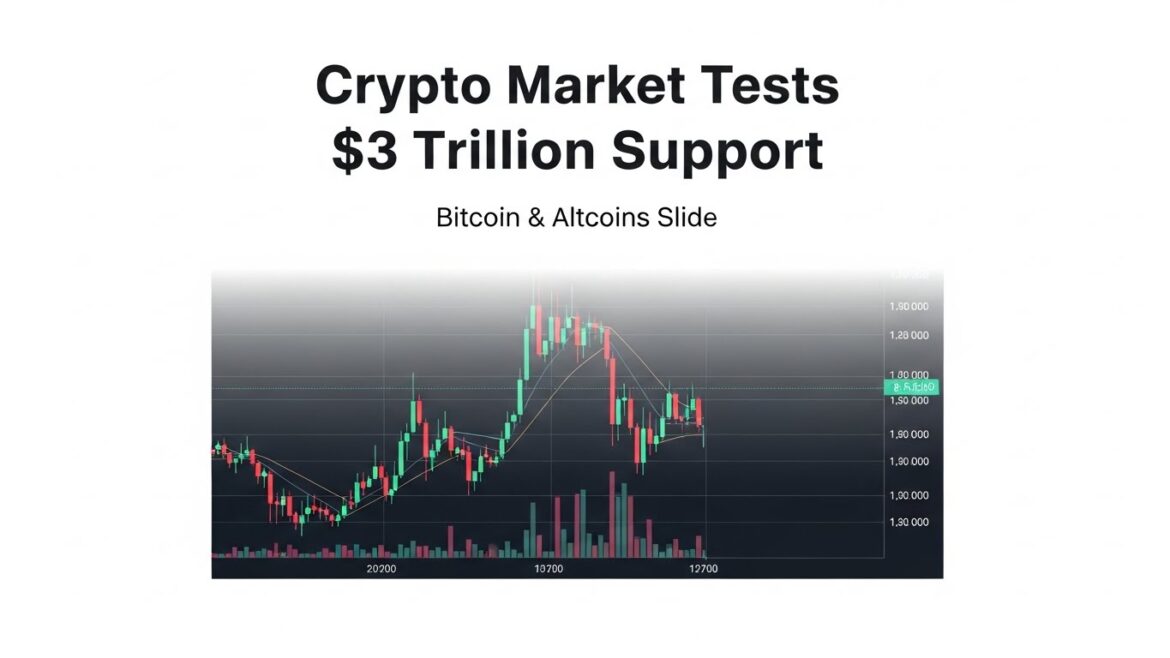

Bitcoin, Ethereum’s Ether, and XRP have all experienced substantial declines, sending shockwaves through the cryptocurrency ecosystem and leaving investors questioning whether this critical support level will hold. This significant downturn marks a pivotal moment for the digital asset space, as the crypto market tests $3 trillion support amid concerns about regulatory developments, macroeconomic factors, and shifting investor sentiment. Understanding what’s driving this decline and what it means for the future of cryptocurrency investments has become crucial for both seasoned traders and newcomers to the space.

Current Crypto Market Downturn

What’s Driving the Decline in Digital Assets?

The recent slide in cryptocurrency prices didn’t happen in isolation. Multiple factors have converged to create a perfect storm that has pushed the crypto market tests $3 trillion threshold. Global economic uncertainty, including persistent inflation concerns and central bank policy adjustments, has led investors to reassess their risk exposure across all asset classes, including digital currencies.

The Federal Reserve’s stance on interest rates continues to cast a long shadow over speculative assets. When traditional safe-haven investments offer competitive yields, the appeal of high-volatility cryptocurrencies diminishes for risk-averse investors. This shift in capital allocation has contributed significantly to the current market pressure.

Additionally, regulatory scrutiny has intensified across multiple jurisdictions. Recent enforcement actions by the Securities and Exchange Commission (SEC) and regulatory developments in Europe and Asia have created an atmosphere of uncertainty. This regulatory overhang has prompted some institutional investors to reduce their exposure to cryptocurrency market capitalization until clearer frameworks emerge.

Bitcoin’s Price Action and Market Leadership

Bitcoin price decline has been particularly noteworthy, given its status as the market’s bellwether asset. Trading below key technical support levels, Bitcoin has dragged down the entire market with it. The flagship cryptocurrency’s dominance means that when Bitcoin falls, it typically triggers a cascading effect across altcoins.

Technical analysts point to several critical support zones that Bitcoin has breached in recent trading sessions. The psychological $40,000 level, once considered a strong floor, has been tested multiple times. Each test of support without a meaningful bounce has eroded confidence among traders who rely on technical indicators for their decision-making.

Mining economics have also played a role in Bitcoin’s struggles. As mining difficulty remains elevated and energy costs fluctuate, some miners have been forced to liquidate portions of their holdings to cover operational expenses. This selling pressure from miners, who historically act as long-term holders, adds to the bearish sentiment.

Ethereum and Ether’s Performance Challenges

The Impact of Network Upgrades and Competition

Ether price movement has shown particular volatility as the Ethereum network faces increasing competition from alternative layer-1 blockchains. While Ethereum remains the dominant platform for decentralized applications and smart contracts, newer competitors offering faster transaction speeds and lower fees have captured market share.

The transition to proof-of-stake consensus, while successful from a technical standpoint, hasn’t provided the price support many investors anticipated. Staking rewards, though attractive, haven’t been sufficient to offset the broader market decline. Currently, millions of Ether remain locked in staking contracts, creating interesting dynamics around supply and demand.

Ethereum’s gas fees, while lower than historical peaks, continue to present challenges for smaller transactions. This has driven activity to layer-2 scaling solutions and competing chains, potentially fragmenting liquidity and reducing network effects. The cryptocurrency market trends suggest that investors are closely watching how Ethereum addresses these scalability challenges while maintaining decentralization.

DeFi and NFT Market Impacts

The decentralized finance ecosystem built primarily on Ethereum has experienced significant contraction. Total value locked (TVL) in DeFi protocols has declined substantially from all-time highs, reflecting reduced user activity and lower asset valuations. This contraction in DeFi activity directly impacts demand for Ether, as the token serves as the primary collateral and gas payment mechanism for these protocols.

NFT market volumes have similarly declined, with major marketplaces reporting reduced transaction activity. The speculative frenzy that characterized the 2021-2022 NFT boom has given way to a more subdued market focused on utility and long-term value. This normalization, while healthy for the ecosystem’s maturity, reduces short-term demand for Ether.

XRP and the Ripple Ecosystem Under Pressure

Legal Developments and Market Sentiment

XRP cryptocurrency news continues to be dominated by ongoing legal proceedings, despite partial victories for Ripple Labs in its case against the SEC. The uncertainty surrounding XRP’s regulatory status in the United States has created persistent selling pressure. Many U.S.-based exchanges remain cautious about offering XRP trading, limiting the token’s liquidity and market access.

International adoption of Ripple’s payment solutions continues to progress, with several financial institutions in Asia and the Middle East implementing RippleNet for cross-border transactions. However, this real-world utility hasn’t translated into price strength during the current market downturn. The disconnect between adoption metrics and price performance highlights how sentiment and regulatory concerns can override fundamental developments.

Cross-Border Payment Competition

The cross-border payment space has become increasingly competitive, with both traditional financial institutions and cryptocurrency projects vying for market share. SWIFT’s improvements to its messaging system and central bank digital currency (CBDC) initiatives present alternative solutions to the problems Ripple seeks to solve. This competitive landscape creates uncertainty about XRP’s long-term value proposition.

Banks and financial institutions are exploring multiple solutions simultaneously, hedging their bets rather than committing fully to any single technology. This diversified approach means that even successful Ripple partnerships may not generate the exclusive adoption that would significantly impact XRP demand in the near term.

The $3 Trillion Support Level: Why It Matters

Historical Context and Market Psychology

The crypto market tests $3 trillion support represents more than just a numerical threshold—it embodies important psychological and technical significance for the entire ecosystem. This level was first achieved during the 2021 bull run and has since acted as a key reference point for measuring market health.

Breaking below $3 trillion in total market capitalization would mark a significant psychological defeat for the cryptocurrency community. Many investors who entered the market during previous bull runs have cost bases above current levels, and further declines could trigger additional capitulation selling. The clustering of stop-loss orders and liquidation levels around major support zones can create self-fulfilling prophecies during downturns.

From a technical analysis perspective, the $3 trillion level aligns with several important Fibonacci retracement levels when measured from the 2020 lows to the 2021 peaks. Technical traders who follow these indicators are watching this support zone carefully, as a decisive break lower could signal additional downside toward the $2.5 trillion or even $2 trillion levels.

Institutional Investment Considerations

Institutional participation in cryptocurrency markets has grown substantially over the past several years, with major hedge funds, asset managers, and corporations adding digital assets to their portfolios. However, institutional investors typically have strict risk management protocols and predetermined exit points.

As the crypto market capitalization decline continues, some institutional players may be approaching their maximum allowable drawdown levels. If these institutions are forced to reduce positions to comply with risk parameters, it could accelerate the decline. Conversely, other institutions with dry powder may view the current levels as attractive entry points, potentially providing buying support.

The approval and growth of spot Bitcoin ETFs has added new dynamics to institutional participation. These investment vehicles make cryptocurrency exposure more accessible to traditional investors, but they also introduce new selling pressures when these investors decide to reduce risk exposure across their portfolios.

Analyzing Broader Cryptocurrency Market Trends

Altcoin Performance and Market Dynamics

Beyond the major cryptocurrencies, the broader altcoin market performance has been particularly challenging. Many smaller-cap tokens have experienced declines exceeding 70-80% from their peak values. This severe correction has eliminated many projects with weak fundamentals while creating opportunities in higher-quality assets trading at depressed valuations.

The correlation between Bitcoin and altcoins remains strong during this downturn. Historically, altcoins tend to underperform Bitcoin during market declines and outperform during recoveries. This pattern suggests that risk appetite must return to the market before meaningful altcoin rallies can occur.

Layer-1 competitors to Ethereum, including Solana, Cardano, and Avalanche, have all struggled to maintain price levels despite continued development progress and growing ecosystem activity. This disconnect between development metrics and price performance illustrates how macro factors can overwhelm project-specific fundamentals during broader market downturns.

Trading Volume and Market Liquidity

Cryptocurrency trading volume has declined significantly across major exchanges, indicating reduced market participation. Lower volumes typically mean wider bid-ask spreads and increased slippage for larger trades, creating challenging conditions for both retail and institutional traders.

Centralized exchange dominance has persisted despite the philosophical appeal of decentralized alternatives. The recent decline has seen volume concentrate further among the largest platforms, as traders prioritize liquidity and reliability over decentralization during volatile periods. This centralization trend presents both opportunities and risks for market stability.

Derivatives markets tell an important story about trader positioning and sentiment. Funding rates for perpetual futures contracts have remained neutral to negative, indicating limited leverage on the long side. Open interest has declined from peaks, suggesting that traders are reducing position sizes rather than aggressively betting on either direction.

Macroeconomic Factors Influencing Digital Assets

Interest Rates and Risk Asset Correlation

The relationship between cryptocurrency prices and interest rates has become increasingly clear. As risk-free rates rise, the opportunity cost of holding non-yielding assets like Bitcoin increases. This dynamic has placed persistent pressure on cryptocurrency valuations throughout the tightening cycle.

Real yields—nominal interest rates minus inflation—are particularly important for understanding cryptocurrency demand. When real yields are deeply negative, hard-capped assets like Bitcoin become more attractive as inflation hedges. However, as real yields turn positive, traditional fixed-income investments regain appeal relative to speculative digital assets.

The cryptocurrency market’s correlation with tech stocks has strengthened considerably. Both asset classes are treated as “risk-on” investments that thrive when liquidity is abundant and struggle when monetary conditions tighten. This correlation means that cryptocurrency investors must pay close attention to Federal Reserve policy decisions and inflation data.

Global Economic Uncertainty and Safe Haven Flows

Geopolitical tensions and economic uncertainty typically drive investors toward established safe-haven assets like gold, U.S. Treasuries, and the dollar. While some cryptocurrency proponents argue that Bitcoin should serve as “digital gold,” the market hasn’t consistently demonstrated this behavior during stress periods.

The current environment features multiple sources of uncertainty: trade tensions, regional conflicts, banking sector concerns, and debt sustainability questions. Rather than benefiting cryptocurrencies, this uncertainty has generally prompted investors to reduce exposure to all speculative assets in favor of traditional safe havens.

Currency volatility in emerging markets sometimes drives local adoption of cryptocurrencies as alternative stores of value. However, this localized demand hasn’t been sufficient to offset selling pressure from large holders in developed markets during the current Bitcoin Ether XRP price decline phase.

Technical Analysis and Key Support Levels

Bitcoin’s Critical Price Zones

From a technical perspective, Bitcoin support levels are clustered around several key zones. The $38,000-$40,000 range represents immediate support, where previous accumulation occurred and where multiple technical indicators converge. A sustained break below this zone would likely trigger accelerated selling toward the $32,000-$35,000 region.

Moving averages provide important context for trend direction. Bitcoin currently trades below its 200-day moving average, a widely-watched indicator that suggests the long-term trend has turned bearish. Historically, extended periods below this moving average have characterized major bear markets requiring months to resolve.

Relative Strength Index (RSI) readings show Bitcoin approaching oversold territory on daily timeframes, which sometimes precedes short-term bounces. However, during strong downtrends, assets can remain oversold for extended periods, so RSI alone doesn’t provide timing signals for reversal.

Ethereum’s Technical Picture

Ethereum technical analysis reveals similar patterns to Bitcoin, with key support around the $2,000 psychological level. The ETH/BTC trading pair has also weakened, indicating that Ethereum is underperforming Bitcoin—typically a sign of broad risk-off sentiment in the cryptocurrency market.

The ascending channel that supported Ethereum throughout much of 2024 has been decisively broken to the downside. This technical breakdown suggests that the path of least resistance is lower unless strong catalysts emerge to reverse sentiment. Chart patterns like this often lead to retests of the broken support (now resistance) before further declines.

Volume profile analysis shows significant prior accumulation zones between $1,800-$2,200, which could provide support if current levels fail. However, volume at purchase significantly exceeds current trading volumes, meaning these support zones could give way if selling pressure intensifies.

Regulatory Landscape and Market Impact

SEC Enforcement and Policy Direction

The cryptocurrency regulatory environment continues evolving rapidly, with the SEC maintaining an aggressive enforcement posture toward projects it deems to be unregistered securities offerings. This regulatory uncertainty creates persistent headwinds for cryptocurrency valuations, as projects and investors navigate an unclear legal landscape.

Recent enforcement actions have targeted both centralized platforms and decentralized protocols, demonstrating the SEC’s expansive interpretation of its jurisdiction. While some court rulings have favored the cryptocurrency industry, the overall trajectory suggests increasing regulatory oversight rather than the light-touch approach some market participants had hoped for.

The political dimension of cryptocurrency regulation adds another layer of complexity. Different presidential administrations and congressional compositions bring varying approaches to digital asset policy. This political uncertainty makes long-term planning difficult for cryptocurrency businesses and investors alike.

International Regulatory Developments

Europe’s Markets in Crypto-Assets (MiCA) regulation represents a comprehensive framework that will govern cryptocurrency activities across EU member states. While providing clarity, MiCA also imposes significant compliance requirements that may challenge smaller projects and platforms. The global cryptocurrency market impact of MiCA remains to be seen as implementation proceeds.

Asian jurisdictions present a mixed picture, with some countries like Singapore maintaining relatively open approaches while others like China maintain comprehensive bans. This fragmented global regulatory landscape creates arbitrage opportunities but also compliance challenges for projects seeking worldwide reach.

Central bank digital currencies (CBDCs) represent both competition and validation for cryptocurrencies. As central banks develop digital versions of national currencies, they legitimize blockchain technology while potentially offering government-backed alternatives to private cryptocurrencies. The interaction between CBDCs and existing cryptocurrencies will shape the market’s evolution.

Investment Strategies During Market Downturns

Dollar-Cost Averaging and Accumulation

Experienced cryptocurrency investors often view market downturns as accumulation opportunities rather than causes for panic. Dollar-cost averaging—investing fixed amounts at regular intervals—helps mitigate timing risk and build positions gradually at favorable average prices. This approach is particularly relevant when the crypto market tests $3 trillion support and volatility remains elevated.

The key to successful accumulation strategies is maintaining strict discipline and not overextending financially. Even during downturns, cryptocurrencies carry substantial risk, and investors should never allocate more capital than they can afford to lose. Position sizing becomes critical—smaller, regular purchases preserve capital for additional opportunities if prices decline further.

Different accumulation strategies suit different risk tolerances. Conservative approaches focus exclusively on Bitcoin and Ethereum, while more aggressive strategies include selective altcoin positions. The appropriate strategy depends on individual financial situations, time horizons, and risk capacity.

Risk Management and Portfolio Allocation

Proper risk management is essential during cryptocurrency market volatility periods. This includes setting stop-losses, maintaining diversification across assets and asset classes, and regularly rebalancing portfolios to maintain target allocations. Many investors make the mistake of concentrating too heavily in cryptocurrencies relative to their overall net worth.

The traditional financial planning guideline of not exceeding 5-10% portfolio allocation to speculative assets applies particularly to cryptocurrencies. While some investors with high risk tolerance allocate more aggressively, this approach carries substantial downside risk that may not align with long-term financial goals.

Tax-loss harvesting presents opportunities during market downturns for investors in taxable accounts. By strategically realizing losses, investors can offset gains elsewhere in their portfolios while maintaining similar cryptocurrency exposure through immediate repurchase (wash sale rules don’t apply to cryptocurrencies in most jurisdictions).

Future Outlook for Major Cryptocurrencies

Bitcoin’s Long-Term Value Proposition

Despite current challenges, Bitcoin’s long-term outlook remains grounded in its unique properties: fixed supply, decentralization, and growing acceptance as an alternative monetary asset. The narrative around Bitcoin as “digital gold” may take years or decades to fully play out, requiring patient capital and conviction through volatile periods.

Institutional infrastructure continues developing regardless of short-term price movements. Custody solutions, insurance products, lending platforms, and regulatory frameworks are all maturing, creating more robust foundations for future growth. This infrastructure development occurs largely independent of daily price action.

The Bitcoin halving cycle, which reduces new supply issuance approximately every four years, remains a fundamental factor influencing long-term supply dynamics. While past performance doesn’t guarantee future results, previous halving cycles have preceded major bull markets, though with increasingly diminished magnitude.

Ethereum’s Evolving Ecosystem

Ethereum’s future development focuses heavily on scalability improvements through layer-2 rollups and eventual sharding implementation. Successfully solving the blockchain trilemma—achieving scalability, security, and decentralization simultaneously—would significantly strengthen Ethereum’s competitive position against emerging rivals.

The transition to proof-of-stake has positioned Ethereum as a more environmentally sustainable platform, addressing one of the major criticisms of cryptocurrency generally. This improved sustainability profile could facilitate broader institutional adoption as ESG considerations become increasingly important in investment decisions.

Application-layer innovation on Ethereum continues despite market downturns. Real-world asset tokenization, decentralized social networks, and improved DeFi protocols represent areas where fundamental development proceeds regardless of price. These innovations create potential catalysts for future demand as the market cycle turns.

XRP and Payment Network Adoption

For XRP, the path forward depends significantly on regulatory clarity and continued adoption of Ripple’s payment solutions. XRP future price potential is closely tied to the breadth and depth of RippleNet implementation by financial institutions. Achieving critical mass in cross-border payment volume would represent a major fundamental driver.

The broader evolution of payment systems, including instant payment rails and correspondent banking improvements, will determine XRP’s competitive positioning. Success requires not just technical merit but also business development execution and navigating complex relationships with traditional financial institutions.

Tokenomics considerations around XRP’s large circulating supply and Ripple’s holdings create ongoing discussions about long-term value accrual. How payment volume translates to token demand—and whether programmatic selling by Ripple offsets this demand—remains debated among investors and analysts.

Comparing Current Conditions to Previous Bear Markets

Historical Bear Market Patterns

Examining previous cryptocurrency bear markets provides useful context for current conditions. The 2018 bear market saw Bitcoin decline approximately 84% from peak to trough, while many altcoins lost 90-95% of their value. The current cryptocurrency market decline has been less severe to date, though duration and ultimate depth remain uncertain.

Recovery timeframes from previous bear markets have varied considerably. The 2018 decline required nearly three years before Bitcoin convincingly surpassed its prior highs. The COVID-19 market crash of March 2020 reversed within months. These historical precedents suggest that recovery duration depends on the underlying causes of the decline and broader economic conditions.

Market structure has evolved significantly since previous bear markets. Spot ETFs, greater institutional participation, more developed derivatives markets, and improved infrastructure all represent differences that may influence this cycle’s trajectory. Whether these changes ultimately prove stabilizing or introduce new risks remains debated.

Key Differences in Today’s Market

The current market environment features several unique characteristics compared to previous downturns. Institutional participation is significantly higher, potentially providing deeper liquidity and reducing the likelihood of extreme volatility spikes. However, institutional capital can also exit quickly when risk parameters are breached.

Regulatory clarity has improved in some jurisdictions while deteriorating in others, creating a complex patchwork that differs from the regulatory vacuum of earlier cryptocurrency eras. This mixed regulatory environment creates opportunities in favorable jurisdictions while constraining growth in others.

Macroeconomic conditions differ substantially from previous cycles. The transition from an ultra-low interest rate environment to normalized rates represents a major shift in the opportunity cost of holding risk assets. Previous cryptocurrency bull markets occurred during periods of monetary easing—the opposite of current conditions.

Expert Opinions and Market Sentiment

Analyst Perspectives on Support Levels

Prominent cryptocurrency analysts offer varying views on whether the $3 trillion market cap support will hold. Bulls argue that current valuations represent attractive entry points given long-term fundamentals, while bears contend that further downside is necessary to fully flush out speculative excess from the system.

On-chain analysis provides data-driven perspectives on market health. Metrics like realized price, MVRV ratios, and long-term holder behavior suggest that substantial capitulation has already occurred, potentially indicating proximity to cycle lows. However, these indicators have provided false signals during previous downturns.

Traditional financial analysts from major institutions increasingly cover cryptocurrency markets, bringing new analytical frameworks and perspectives. Their generally more conservative outlook contrasts with native cryptocurrency analyst optimism, reflecting different methodologies and assumptions about digital asset valuation.

Sentiment Indicators and Market Psychology

Fear and Greed indices for cryptocurrency markets currently show extreme fear, historically associated with market bottoms. However, sentiment can remain pessimistic for extended periods, and timing market turns based solely on sentiment proves extremely difficult even with clear indicators.

Social media analysis and search trend data reveal declining public interest in cryptocurrencies compared to bull market peaks. This reduced attention typically characterizes bear market conditions and often persists until new catalysts emerge to re-engage retail participation.

Survey data from institutional investors shows varying levels of conviction, with some maintaining or increasing allocations while others reduce exposure. This diversity of professional opinion reflects genuine uncertainty about near-term direction and appropriate valuation levels.

Lessons for Cryptocurrency Investors

Managing Expectations and Risk

The current market environment reinforces important lessons about cryptocurrency investment strategies and risk management. Volatility remains an inherent characteristic of digital asset markets, and investors must maintain realistic expectations about both upside potential and downside risk.

Diversification across asset classes—not just within cryptocurrencies—remains crucial for overall portfolio health. Even investors bullish on cryptocurrencies’ long-term prospects benefit from balancing this exposure with traditional assets that may perform differently across various market environments.

Emotional discipline separates successful long-term investors from those who buy tops and sell bottoms. Developing clear investment theses, maintaining predetermined position sizes, and avoiding reactionary decisions based on short-term price movements all contribute to better outcomes.

Building Knowledge and Skills

Bear markets provide excellent opportunities for education and skill development. With reduced FOMO and mania, investors can focus on understanding blockchain technology, analyzing project fundamentals, learning technical analysis, and developing informed perspectives on different protocols and use cases.

Engaging with cryptocurrency communities, reading project documentation, experimenting with DeFi applications on testnets, and following reputable researchers all contribute to deeper understanding. This knowledge foundation proves invaluable when markets eventually recover and new opportunities emerge.

Critical thinking remains essential when consuming cryptocurrency content. The space attracts both brilliant innovators and opportunistic promoters, requiring careful evaluation of information sources and claims. Developing the ability to distinguish signal from noise improves investment decision-making substantially.

Conclusion

As the crypto market tests $3 trillion in total capitalization, investors and enthusiasts face a critical juncture that will likely define the trajectory of digital assets for months or years ahead. The simultaneous decline in Bitcoin, Ether, and XRP reflects broad-based pressure rather than isolated weakness, highlighting how correlated cryptocurrency markets remain during downturns.

Whether this support level holds or gives way to further declines will depend on numerous factors: macroeconomic conditions, regulatory developments, institutional flows, and the overall risk appetite in financial markets. While short-term price predictions remain speculative, the long-term case for blockchain technology and cryptocurrency adoption continues developing regardless of daily fluctuations.

Successful navigation of the current environment requires balancing conviction with caution, maintaining appropriate risk levels, and focusing on long-term fundamentals rather than short-term noise. For those with appropriate risk tolerance and time horizons, periods when the cryptocurrency market faces significant pressure have historically presented asymmetric opportunities.

See more;Bitcoin Price Prediction Technical Analysis Today 2025