The strategy bitcoin breakeven level became the center of attention as the digital asset giant’s stock price experienced turbulence. This development sent shockwaves through the investment community, particularly among shareholders who have watched the company’s aggressive bitcoin acquisition strategy unfold over recent months. The bitcoin breakeven level for Strategy represents a critical threshold that determines whether the company’s substantial cryptocurrency holdings are positioned profitably or underwater, making this brief dip below that mark a significant psychological and financial milestone for investors tracking the firm’s performance.

Strategy, formerly known as MicroStrategy, has transformed itself from a traditional business intelligence company into what many consider a leveraged bitcoin investment vehicle. The company’s executive chairman, Michael Saylor, has championed an unprecedented corporate treasury strategy centered on accumulating bitcoin through various financing mechanisms. When bitcoin briefly dips below this crucial threshold, it raises fundamental questions about the sustainability of this approach and whether other corporations will follow suit or reconsider their cryptocurrency exposure.

Strategy’s Bitcoin Accumulation Approach

Strategy has pursued an extraordinarily ambitious path in corporate finance by making bitcoin the cornerstone of its treasury management. The company has acquired tens of thousands of bitcoins through a combination of cash purchases, debt offerings, and equity raises, fundamentally reshaping its business model and market positioning.

The crypto firm’s key breakeven calculation represents the average price at which Strategy has acquired its bitcoin holdings. This metric has become increasingly important for investors because it provides a clear benchmark for evaluating whether the company’s cryptocurrency strategy is generating value or experiencing losses. Unlike traditional companies that might hold modest cryptocurrency positions as part of diversified treasury operations, Strategy has concentrated its resources so heavily in bitcoin that the digital asset’s price movements directly impact the company’s perceived financial health.

The Mathematics Behind the Breakeven Threshold

Calculating Strategy’s breakeven level requires accounting for all bitcoin purchases the company has made, weighted by the acquisition prices and quantities. As Strategy has continued acquiring bitcoin at various price points throughout different market cycles, this average cost basis has fluctuated. When bitcoin trades above this level, the company’s holdings show unrealized gains. When the cryptocurrency falls below it, those holdings reflect unrealized losses.

The significance of the bitcoin breakeven point extends beyond simple accounting. For Strategy, which has issued convertible debt and other financial instruments to fund its bitcoin purchases, the cryptocurrency’s price relative to the breakeven level affects the company’s leverage ratios, debt covenants, and overall financial flexibility. Investors closely monitor whether bitcoin remains above or below this threshold because it signals the immediate profitability of what has become the company’s primary value proposition.

Market Reactions to the Brief Price Decline

When bitcoin briefly dips below crypto firm’s critical threshold, market participants react swiftly. Strategy’s stock price typically exhibits high correlation with bitcoin’s movements, often with amplified volatility in both directions. The company’s equity effectively functions as a leveraged play on bitcoin, meaning that percentage moves in the cryptocurrency translate to even larger percentage swings in the stock price.

Investor Sentiment and Stock Performance

The moments when bitcoin dips below Strategy’s acquisition cost generate heightened anxiety among equity holders. These investors have effectively placed a bet not just on bitcoin’s long-term appreciation but on the management team’s ability to time accumulation periods effectively and maintain financial stability through inevitable market downturns. A breach of the breakeven level, even temporarily, challenges the narrative that Strategy’s aggressive accumulation strategy represents sound corporate treasury management.

Analysts tracking Strategy note that the company’s stock often trades at either a premium or discount to the net asset value of its bitcoin holdings, depending on market sentiment. When bitcoin falls below the average purchase price, this relationship can become strained as investors reassess whether the company’s approach creates or destroys shareholder value. The premium that investors might pay for Strategy’s equity over its bitcoin holdings shrinks or disappears entirely when the cryptocurrency trades near or below the company’s cost basis.

The Broader Implications for Corporate Bitcoin Adoption

Strategy’s experience serves as a high-profile test case for corporate bitcoin adoption. The company’s willingness to accumulate such substantial cryptocurrency holdings has positioned it as either a visionary pioneer or a cautionary tale, depending on bitcoin’s price trajectory and the observer’s perspective on digital asset investment.

Corporate Treasury Evolution

Traditional corporate treasury management emphasizes capital preservation, liquidity maintenance, and predictable returns. Strategy’s approach represents a radical departure from these principles, substituting the volatility and potential appreciation of bitcoin for the stability of conventional cash equivalents. When the crypto firm’s breakeven point comes into focus due to price movements, it highlights the fundamental tension between these competing treasury philosophies.

Other companies observing Strategy’s journey must weigh the potential for substantial gains if bitcoin appreciates against the very real possibility of periods where holdings trade below acquisition costs. The breakeven level becomes a concrete demonstration of downside risk, making abstract discussions about cryptocurrency volatility suddenly tangible for corporate boards considering similar strategies.

Leverage Considerations and Financial Engineering

Strategy has not merely purchased bitcoin with cash reserves. The company has employed sophisticated financial engineering, including convertible note offerings and at-the-market equity programs, to fund its accumulation strategy. This leverage amplifies both potential gains and potential losses, making the relationship between bitcoin’s price and the company’s breakeven threshold even more consequential.

When bitcoin briefly falls below the average acquisition cost, questions arise about the company’s ability to service debt, maintain compliance with financial covenants, and continue funding operations. The financial structure Strategy has created means that sustained bitcoin weakness relative to the breakeven point could force difficult decisions about asset sales, operational adjustments, or changes to the accumulation strategy itself.

Technical Analysis of Bitcoin’s Price Movement

Understanding why bitcoin dips requires examining the broader cryptocurrency market dynamics, macroeconomic factors, and technical trading patterns that influence digital asset prices. Bitcoin’s volatility remains substantially higher than traditional assets, with price swings of ten percent or more occurring within single trading sessions during periods of market stress or euphoria.

Market Catalysts and Price Drivers

Bitcoin’s price movements respond to numerous factors including regulatory developments, institutional adoption trends, macroeconomic conditions, and technical chart patterns. When the cryptocurrency approaches significant technical levels, including corporate breakeven thresholds for major holders like Strategy, trading activity often intensifies as investors position themselves for potential breakouts or breakdowns.

The brief penetration of Strategy’s acquisition cost likely reflected a combination of profit-taking after previous gains, macroeconomic concerns affecting risk assets broadly, or technical selling as bitcoin tested support levels. These movements, while dramatic in the moment, represent normal cryptocurrency market behavior given bitcoin’s historical volatility profile.

Support and Resistance Dynamics

Technical analysts identify price levels where buying or selling pressure historically concentrates, creating support zones where declines tend to pause and resistance areas where rallies stall. Strategy’s average purchase price has itself become a psychological level for some traders who monitor corporate bitcoin holdings. When bitcoin approaches this threshold from above, it can attract buying from investors who view Strategy’s accumulation strategy as validation or from the company itself if it chooses to add to positions at favorable prices.

The fact that bitcoin only briefly dipped below this level before recovering suggests that buying interest emerged quickly, whether from Strategy, its supporters, or other market participants who saw the price as attractive. This resilience at the breakeven point provides some reassurance to investors concerned about sustained weakness that might pressure the company’s financial position.

Risk Management and Strategic Considerations

Strategy’s approach to bitcoin accumulation raises important questions about corporate risk management, fiduciary responsibility, and strategic vision. The company’s leadership has articulated a long-term conviction that bitcoin represents superior treasury reserve asset compared to cash, but this thesis faces real-world testing when the cryptocurrency trades near or below acquisition costs.

Diversification Versus Concentration

Traditional portfolio theory emphasizes diversification as a method of reducing unsystematic risk. Strategy has pursued the opposite approach, concentrating its resources in a single volatile asset class. This concentration creates the potential for outsized returns if bitcoin appreciates substantially but also exposes the company to significant downside if the cryptocurrency experiences sustained weakness.

The moments when bitcoin tests the company’s breakeven threshold force a confrontation with this concentration risk. Investors must decide whether they believe in the long-term bitcoin thesis strongly enough to accept periods of unrealized losses or whether prudent risk management would have dictated more diversified holdings.

Time Horizon and Volatility Tolerance

Strategy’s leadership has consistently emphasized their long-term investment horizon, arguing that short-term price fluctuations are irrelevant to their ultimate thesis about bitcoin’s role in the global financial system. This perspective requires investors to maintain similar time horizons and volatility tolerance, accepting that the average cost basis will sometimes exceed bitcoin’s market price without viewing such periods as failures of strategy.

The challenge for the company lies in maintaining financial flexibility and stakeholder confidence during extended periods when bitcoin trades below the breakeven level. While unrealized losses don’t immediately impair operations, they affect market capitalization, borrowing capacity, and the company’s ability to raise additional capital for continued accumulation or business operations.

Competitive Landscape and Industry Positioning

Strategy operates in a unique position within both the cryptocurrency industry and the corporate landscape. Few public companies have embraced bitcoin with similar conviction, making Strategy’s performance and stock price movements important indicators for how markets value corporate cryptocurrency strategies.

Corporate Bitcoin Holdings Comparison

While several public companies hold bitcoin on their balance sheets, Strategy’s holdings dwarf those of most peers in both absolute and relative terms. This leadership position makes the company’s breakeven calculation particularly noteworthy as a benchmark for corporate bitcoin adoption more broadly. When Strategy’s acquisition cost comes into focus due to price movements, it provides a reference point for other companies evaluating their own cryptocurrency positions.

The competitive dynamics extend beyond simply holding bitcoin. Strategy has positioned itself as an advocate for corporate adoption, with leadership actively promoting the benefits of bitcoin treasury strategies through conferences, media appearances, and educational initiatives. This evangelism enhances the company’s profile but also creates additional scrutiny when bitcoin trades near unfavorable levels relative to the firm’s cost basis.

Market Positioning and Brand Identity

Strategy has essentially rebranded itself around bitcoin, moving from a business intelligence software company to what investors now view primarily as a cryptocurrency investment vehicle with legacy software operations. This transformation means the company’s market positioning rises and falls with bitcoin’s fortunes and with perceptions about the viability of corporate cryptocurrency strategies.

When bitcoin approaches or breaches critical price levels like the company’s average purchase price, it tests the sustainability of this positioning. Investors must evaluate whether Strategy’s software business provides sufficient stable cash flow to support the company through cryptocurrency market cycles or whether extended bitcoin weakness would fundamentally challenge the business model.

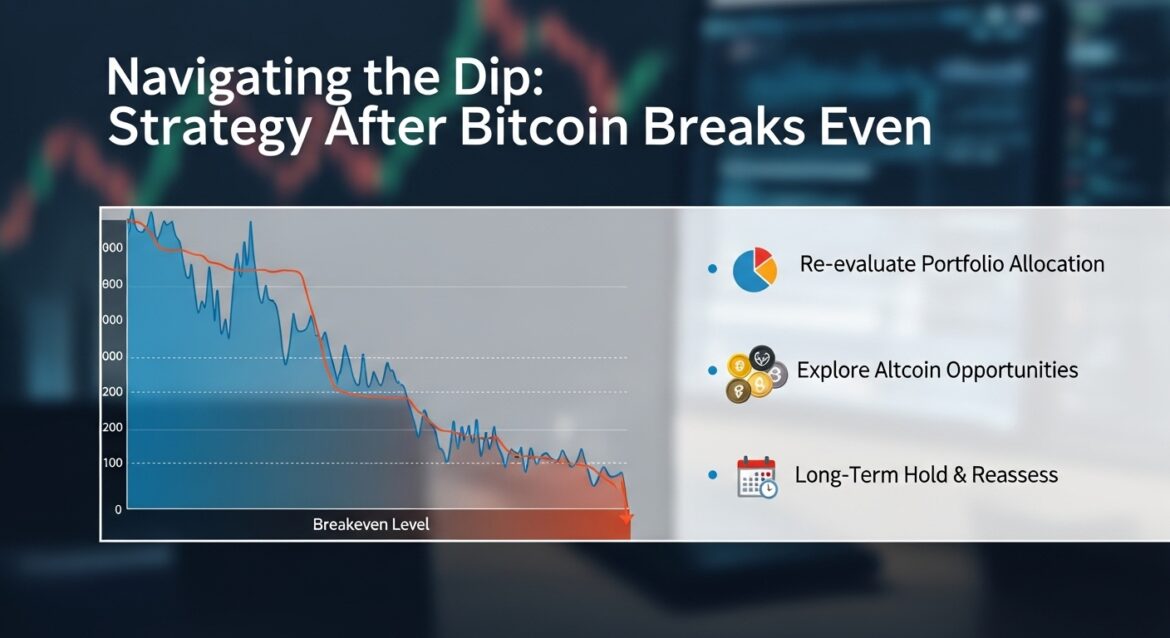

Future Outlook and Strategic Options

As Strategy navigates bitcoin’s volatility and occasional dips toward or below its breakeven threshold, the company faces several strategic options for managing its cryptocurrency position and overall business direction.

Continued Accumulation Strategy

Strategy’s leadership has shown consistent commitment to acquiring additional bitcoin, viewing price weakness as an opportunity rather than a reason for concern. This approach suggests that periods when bitcoin trades near the company’s average cost might actually accelerate purchases as management attempts to lower the overall breakeven level through opportunistic buying.

This strategy requires either generating sufficient cash flow from operations, accessing capital markets for additional funding, or utilizing existing liquidity reserves. The feasibility of continued accumulation depends partly on investor willingness to provide capital for this purpose and partly on the company’s ability to maintain financial covenants and operational stability.

Portfolio Rebalancing Considerations

While Strategy has shown no indication of reducing bitcoin exposure, extended periods of cryptocurrency weakness relative to the acquisition threshold might eventually prompt discussions about portfolio rebalancing or risk management adjustments. These could include derivatives strategies to hedge downside exposure, partial position reductions to enhance liquidity, or diversification into other assets while maintaining substantial bitcoin exposure.

Any moves away from pure bitcoin concentration would represent a significant strategic shift given the company’s strong public commitment to its current approach. However, fiduciary responsibilities to shareholders and debt holders might eventually require such considerations if bitcoin experienced truly sustained weakness that threatened the company’s financial position.

Lessons for Investors and Corporate Treasurers

Strategy’s experience provides valuable insights for both individual investors considering cryptocurrency exposure and corporate treasurers evaluating digital asset allocation decisions.

Volatility Expectations and Risk Tolerance

The periodic tests of Strategy’s breakeven point demonstrate that even long-term bitcoin bulls should expect substantial volatility and prepare psychologically and financially for periods when holdings show unrealized losses. This volatility tolerance must extend beyond abstract acceptance to concrete preparation including sufficient liquidity, appropriate time horizons, and absence of forced selling scenarios.

Corporate treasurers can observe that bitcoin’s price movements create real governance, reporting, and stakeholder management challenges even for companies committed to long-term holding strategies. The simplicity of “buy and hold forever” becomes complicated when quarterly reporting cycles, debt covenant requirements, and shareholder expectations demand ongoing explanation of position performance.

Due Diligence and Strategy Evaluation

Investors in Strategy or similar vehicles must understand that they are effectively making leveraged bets on bitcoin rather than simply investing in operating businesses that happen to hold cryptocurrency. The tight relationship between bitcoin’s price and the company’s stock performance, particularly around critical levels like the average acquisition cost, means that cryptocurrency market analysis becomes as important as traditional equity analysis.

This evaluation should include understanding the company’s total cost basis, the financial instruments used to fund purchases, the cash flow from operations available to service debt and fund additional accumulation, and the management team’s demonstrated commitment to the strategy through various market cycles.

Conclusion

The moment when Strategy bitcoin breakeven level briefly came under pressure from declining cryptocurrency prices represents more than a isolated market event. It embodies the fundamental tension between traditional corporate treasury management and innovative approaches to capital allocation in the digital asset era. Strategy’s willingness to concentrate resources in bitcoin has created a unique investment vehicle that amplifies both the potential rewards and risks of cryptocurrency exposure.

For investors monitoring the crypto firm’s breakeven threshold, these price movements provide critical information about the company’s financial positioning and the viability of aggressive bitcoin accumulation strategies. The brief nature of the dip below this key level suggests resilient demand for bitcoin and confidence in Strategy’s long-term approach, though future tests of this threshold appear inevitable given cryptocurrency market volatility.

As corporate adoption of bitcoin evolves, Strategy’s experience will continue providing valuable case study material for treasurers, investors, and analysts evaluating digital asset strategies. Whether the company’s concentrated approach ultimately proves visionary or cautionary depends largely on bitcoin’s long-term trajectory relative to these critical breakeven calculations.

See more; Ethereum Price Prediction: ETH Trades Near $3,230 Recovery